Ist Venmo sicher? Die Leute machen diese Sorge insbesondere für Venmo -Nutzer im Teenageralter. Digitale Zahlungs -Apps befinden sich in allen Ecken des Marktes und vereinfachen die Transaktionen, setzen Benutzer jedoch gefährliche Situationen aus. Venmo fungiert als weit verbreitete Zahlungsmethode mit Schutzsicherheitsmaßnahmen, die unvollständigen Schutz bieten. Das System steht vor Sicherheitsbedrohungen von Hackern in Kombination mit Betrug und Datenschutzrisiken.

Ihr Teenager muss die Zwei-Faktor-Authentifizierung zusammen mit der Vermeidung öffentlicher Transaktionen ermöglichen und sich weigerten, Geld an unbekannt Personen zu senden, um sicher zu bleiben. Die Praxis der Venmosicherheit schützt die Benutzer vor geldbezogenen Problemen. Behalten Sie das Sicherheitsbewusstsein bei und verwenden Sie starke Passwörter, die Sie mit Überwachungssystemen verfolgen sollten. Lass uns eintauchen!

Was ist Venmo?

Mit dem Mobile Payment System Venmo können Benutzer sofort Geldtransfers über seine Plattform durchführen. Die Peer-to-Peer-Zahlungsanwendung gehört zu PayPal und genießt die weit verbreitete Benutzerakzeptanz unter den Benutzern.

Warum ist Venmo so beliebt?

- Einfach zu bedienen: Benutzer können Zahlungen sofort aktivieren, indem sie ihr Bankkonto oder ihre Zahlungskarte verbinden.

- Schnelle Transaktionen: Benutzer profitieren von sofortigen Geldtransfers durch die Anwendung.

- Soziale Funktionen: Benutzer können Zahlungen verbessern, indem sie Emojis sowie Kommentare durch die sozialen Funktionen hinzufügen.

- Weithin akzeptiert: Eine große Anzahl von Nutzern ist auf Venmo angewiesen, da Freunde und Familienmitglieder es zusammen mit einigen Unternehmen nutzen.

Wer benutzt Venmo?

- Millennials & Gen Z: Mitglieder von Millennials und Gen Z verteilen und bezahlen Ausgaben als Gruppe durch Venmo leicht.

- Freiberufler: Die Plattform dient freiberufliche Mitarbeiter, die sich für Venmo entscheiden, um schnelle Zahlungen zu erhalten.

- Kleinunternehmen: Eine Auswahl kleiner Unternehmen ermöglicht die Zahlungen über Venmo aufgrund ihrer einfachen Verarbeitungsfähigkeiten.

Der schnelle und unterhaltsame Venmo -Service bietet ein hervorragendes Zahlungserlebnis, aber was ist mit seinen Sicherheitsmaßnahmen? Hier werden die Dinge schwierig.

Was macht Venmo sicher?

Venmo bietet Benutzern zusätzlich zu den schnellen Zahlungsfunktionen zusätzliche Sicherheitsprotokolle. Aber ist es genug?

In der Echtzeitüberwachung erhalten Sie jedoch eine zusätzliche Schutzschicht.

Die Sicherheitsmaßnahmen von Venmo

- Verschlüsselung: Sie schützt Ihre Finanzdaten vor Hackern.

- Zwei-Faktor-Authentifizierung (2FA): Sie fügt eine zusätzliche Sicherheitsebene hinzu.

- Transaktionsüberwachung: Seine Funktion innerhalb von Venmo führt kontinuierlich nach illegalen Transaktionen und zweifelhaften Kontoaktivitäten durch.

einstellungen

Die Plattform präsentiert dem allgemeinen Publikum derzeit alle Zahlungsaktivitäten durch ihren Standard einstellungen , der ein kritischer Nachteil bleibt. Benutzer können:

- Setzen Sie Transaktionen auf private: Durch private Einstellung sind Sie und Ihre Empfänger die einzigen Zuschauer von Transaktionsinformationen.

- Verwalten Sie Freundeslisten: Sie können Ihre Freundesliste verarbeiten, um zu bestimmen, welche Benutzer zugreifen können.

Achten Sie auf den Venmo -Betrug?

Sicherheitsmerkmale können die Existenz von Betrügern auf Venmo nicht beseitigen. Zu den drei Hauptrisiken für die Verwendung von Venmo gehören gefälschte Käufer sowie Phishing -Angriffe und Überzahlungsbetrug. Sie sollten immer die Identität der Person bestätigen, die Ihr Geld erhält. Eine Transaktion sollte als misstrauisch angesehen werden, wenn sie sich nicht vertrauenswürdig anfühlt.

Die Verwendung von Venmo führt sicher zu seinem sicheren Betrieb. Behalten Sie Ihre Wachsamkeit bei, passen Sie Ihre Datenschutzoptionen an und ignorieren Sie sofort alle verdächtigen Anfragen, die vor Ihnen erscheinen.

Häufige Bedenken hinsichtlich der Sicherheit von Venmo

Die Benutzerfreundlichkeit von Venmo sollte mit ihren tatsächlichen Schutzmaßnahmen verglichen werden. Folgendes müssen Sie wissen.

Datenverletzungen und Sicherheitsbedrohungen

Keine App ist zu 100% hacksicher. Zu den von Cyberkriminellen verwendeten Geldplattformen gehören Venmo zu ihren Zielen. Um dies zu bekämpfen, Venmo:

- Verschlüsselung schützt alle wichtigen Daten, die von der Plattform gespeichert sind.

- Aktualisiert regelmäßig Sicherheitsprotokolle.

- Monitore machen verdächtige Aktivitäten aus.

Clients müssen komplexe Passwörter festlegen, während sie ihre Kontoanmeldeinformationen in ungesicherten drahtlosen Netzwerken nicht verwenden.

Betrug und nicht authorisierte Transaktionen

Venmo ist ein attraktives Ziel für Betrüger durch verschiedene Arten von betrügerischen Aktivitäten.

- Phishing -Angriffe: Die Lieferung falscher E -Mail -Nachrichten gibt vor, legitim zu sein, um Authentifizierungsanmeldeinformationen von Benutzern zu extrahieren.

- Überbezahlung betrügt: Der Betrug enthält Betrüger, die Ihnen zusätzliches Geld geben, in dem sie die Mittel anfordern, bevor der Zahlungsvorgang abgeschlossen ist.

- Gefälschte Käufer und Verkäufer: Venmo bietet seinen Benutzern keinen Schutz, wenn sie Artikel kaufen oder verkaufen, da die Plattform sich weigert, die Sicherheit der Käufer zu garantieren.

Aktivieren Sie die Zwei-Faktor-Authentifizierung, wenn Sie die Venmo-App verwenden, um sicher zu bleiben, da das Senden von Geld an unbekannt -Benutzer immer vermieden werden muss.

Benutzerdatenschutz

Benutzer stellen Venmo Daten zur Verfügung, nachdem das Unternehmen Sicherheitsmaßnahmen zum Schutz seiner Informationen angenommen hat. Die App:

- Verschlüsselt persönliche und finanzielle Informationen.

- Benutzer, die die Plattform nutzen, können ihre Datenschutzsteuerungen festlegen, um die Offenlegung ihrer Daten einzuschränken.

Fazit? Venmo bietet sichere Zahlungsdienste an, wenn Benutzer bei ihrer Verwendung Vorsicht walten lassen. Übungen Sie die Pflege, wenn Sie Ihren einstellungen verwenden, während Sie sich von unrealistisch guten Angeboten fernhalten.

Vergleich von Venmo mit anderen Zahlungsdiensten

Die Zahlungsanträge variieren in der Qualität zwischen verschiedenen Optionen. Die Popularität von Venmo erklärt ihren tatsächlichen Ansehen im Vergleich zu Paypal, Zelle und nicht Cash-App. Lass es uns zusammenbrechen.

Venmo gegen Paypal

PayPal Ope bewertung S als Tochtergesellschaft, obwohl jede Plattform unterschiedliche Eigenschaften beibehält.

Sicherheitsvorrichtungen:

- PayPal bietet Käufer- und Verkäuferschutz an: PayPal hält Kunden sowohl beim Kauf als auch beim Verkauf von Produkten geschützt, indem sie bei betrügerischen Transaktionen Erstattung anbieten. Venmo? Nicht so sehr.

- Venmo ist für persönliche Transaktionen gedacht: Die Plattform von Venmo serviert ausschließlich private Transaktionen, sodass Sie Ihre Zahlung verlieren, wenn Sie Geld für Einkäufe erhalten, was zu betrügerischen Transaktionen führt.

- Verschlüsselungs- und Betrugsüberwachung: Während der Verwendung von Verschlüsselung und Durchführung der Überwachung für betrügerische Aktivitäten repräsentiert die gängigen Sicherheitsmerkmale in beiden Plattformen.

Beste für:

- Die Venmo -Anwendung bietet perfekte Funktionen für die Übertragung von Geld zwischen Freunden ohne formelle Geschäftstransaktionen.

- Wählen Sie PayPal aus, um Zahlungen sowohl über online -Einkaufsmöglichkeiten als auch über Geschäftsbetriebe durchzuführen.

Venmo vs. Zelle und Cash App

Venmo steht Zelle zusammen mit Cash App als führende Wettbewerber auf dem Markt. So vergleichen sie:

Sicherheitsprotokolle:

- Zelle ist von Bank unterstützt: Zelle hält Bank-unterstützte Transaktionsmethoden bei, die eine starke Sicherheit bieten. Benutzer können jedoch nicht verlorenes Geld von bank unterstützten Betrügern zurückerhalten.

- Die Cash -App verfügt über optionale Sicherheitsfunktionen: Kunden, die die Cash -App verwenden, können den PIN -Schutz einschalten, aber ähnlich wie Venmo, ihre Transaktionen werden nach dem Senden unanständig.

Schlüsselunterschiede:

- Venmo & Cash App Halten Sie Geld in Ihrem App -Guthaben: Benutzer, die ihr Geld über Venmo über Cash App speichern, werden im App -Guthaben verbleiben, während Zelle Einlagen direkt auf Bankkonten leitet.

- Zelle hat keine eingebauten sozialen Funktionen: Zelle bewertung ohne integrierte soziale Funktionen, da es keine öffentlichen Transaktionen unterstützt, die den Datenschutzstandards der Benutzer zugute kommen.

- Die Cash -App ermöglicht Bitcoin -Einkäufe: Sie können die Bargeld -App verwenden, um Bitcoin zu kaufen, aber diese Funktion gibt es nicht in Venmo.

Beste für:

- Verwenden Sie Zelle: Bankübertragungen zwischen vertrauenswürdigen Personen können über Zelle behandelt werden.

- Verwenden Sie Bargeld -App: Benutzer, die schnelle Zahlungen und Anlagemöglichkeiten wünschen, sollten Bargeld -App wählen.

- Verwenden Sie Venmo: Benutzer, die einen sozialen Zahlungsdienst mit einfachen Operationen wünschen, sollten Venmo auswählen.

Auswahl des richtigen Zahlungsdienstes

Also, welche App sollten Sie verwenden? Das hängt von Ihren Bedürfnissen ab.

- Für persönliche Zahlungen: Venmo oder Zelle.

- Für Geschäftstransaktionen: PayPal.

- Für die zusätzliche Sicherheit: Die zusätzliche Sicherung von Backup stammt von Zelle, da sie durch Banksysteme bewertung von Banken entspricht.

- Für Flexibilität: Der Benutzer, der flexible Optionen sucht, sollte eine Bargeld -App auswählen, insbesondere wenn er Kryptowährung und Börsenhandel erkunden möchte.

Jede App hat Risiken. Überall existieren Betrüger. Alle Zahlungen sollten zwischen den Benutzern privat bleiben, während Sicherheitsfunktionen aktiviert werden müssen, bevor sie Zahlungen an Personen leisten, die Sie nicht kennen.

Vertrauenswürdigkeit der Venmo -Plattform

Ist es sicher und zuverlässig? Was sind die Venmogrenzen? Der folgende Standpunkt stammt von den Meinungen der Benutzer zusammen mit Expertenbewertungen.

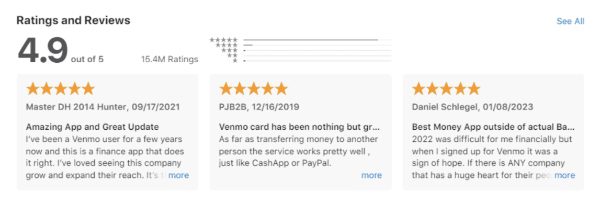

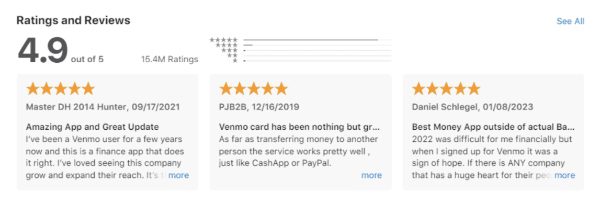

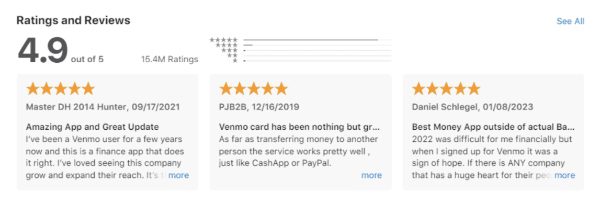

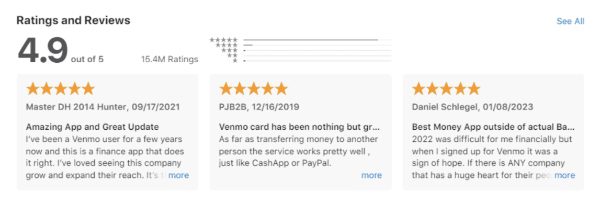

Benutzerbewertungen und Testimonials

Wichtig ist, dass Millionen von Benutzern in Venmo existieren, aber ihre Bewertungen über den Service bleiben inkonsistent.

Positives feedback :

- Benutzer finden Venmo für Bill-Sharing-Zwecke nützlich, da es sich einfach und bequem bewertung befindet.

- Schnelle Transaktionen mit Freunden und Familie.

- Sicherheitsfunktionen wie zwei-Faktor-Authentifizierung.

Negatives feedback :

- Das Hauptproblem von Venmo -Betrügereien tritt typischerweise auf, wenn Benutzer mit unbekannt -Personen interagieren.

- Öffentliche Informationen, die über Venmo geteilt werden, setzt wesentliche persönliche Informationen der öffentlichen Domäne auf.

- Venmo -Benutzer sind gelegentlich eine Herausforderung für ihre Übertragungsbeschränkungen.

Expertenmeinungen

Die Verschlüsselung zusammen mit den Merkmalen der Betrugsprävention bei Venmo wird von Sicherheitsexperten gelobt. Sie warnen jedoch:

- Das Fehlen von Kundenschutz in Venmo macht die Plattform gefährlich für den Kauf von Artikeln aus online -Geschäften.

- Benutzer müssen Datenschutzkonfigurationen ändern, um die Überbelichtung von Informationen zu verhindern.

Ruf in der Branche

Venmo bietet Benutzern einen besseren Komfort als PayPal und bietet seinen Benutzern weniger Sicherheit. Kunden sehen Venmo als eine sichere Option für ihre persönlichen Mittelübertragungen an, sollten jedoch mit Geschäftsangaben Vorsicht walten lassen.

Fazit? Venmo ist sicher, wenn sie mit Bedacht eingesetzt werden. Bleiben Sie über Sicherheitsgrenzen informiert, während Sie Anpassungen an einstellungen vornehmen, und antworten Sie niemals auf seltsame Zahlungsanfragen.

Hat Venmo Teenager -Konten?

Ja! Im Moment bietet Venmo Teenager für Benutzer, die in die Altersspanne von 13-17 fallen. Das Konto bewertung unter der Kontrolle der Eltern, während es finanzielle Fähigkeiten durch sichere Merkmale für Lernzwecke vermittelt.

Ist Venmo für Kinder in Ordnung?

Für Kinder unter 13? Nein. Das Venmo -Zahlungssystem bewertung ist ausschließlich für Benutzer, die Teenager und Erwachsene sind. Das Teen-Account von Venmo bietet alle oben genannten Funktionen für Benutzer in der Altersgruppe 13-17.

- Elternkontrolle: Eltern erhalten Transaktionsüberwachung durch ein Merkmal, mit dem sie feststellen können, was ihre Kinder mit dem System tun können und was nicht.

- Alarme : Die Plattform sendet benachrichtigungen in Bezug auf alle ihre Ausgabenaktivitäten an Benutzer.

- Begrenzte Funktionen: Kein Kryptowährungshandel oder Venmo -Kreditkartenzugang.

Hat Venmo eine Altersüberprüfung?

Ja, aber es ist nicht narrensicher. Der Prozess zur Erstellung eines Venmo -Kontos erfordert die Beteiligung der Eltern, da Jugendliche ihre Erziehungsberechtigten brauchen, um ihr Konto festzulegen. Ein Venmo -Teilnehmer im Teenageralter verlangt von ihren Eltern, sich zuerst anzuschließen und die Identität des Jugendlichen zu beweisen. Es gibt eine Lücke in der strengen Altersüberprüfung für Standard -Venmo -Konten, wodurch jüngere Benutzer das System umgehen können.

Der Teenager -Konto von Venmo bietet den Eltern beruhigend in Bezug auf die finanzielle Sicherheit. Sie sollten das Ausgabenverhalten Ihres Teenagers beobachten und ihnen gemeinsame Venmo -Betrügereien erklären.

Wie können Eltern sicherstellen, dass Venmo für ihre Kinder sicher ist?

Um die Venmosicherheit Ihres Teenagers zu gewährleisten, müssen Sie einen weisen einstellungen mit ständigem Aufsicht ermöglichen. Hier erfahren Sie, wie man es richtig macht:

- Verwenden Sie Venmo Kindersicherung: Eltern, die Teenagerkonten in Venmo erstellen, erhalten Zugriff auf Merkmale, mit denen sie Transaktionen beobachten und die Debitkartenfunktionen einstellen und Fonds -Parameter verwalten können.

- Aktivität der Privatsphäre Einstellungen aktivieren: Die Privatsphäre einstellungen sollte aktiviert werden, indem Transaktionen in den privaten Modus wechseln, um die nicht autorisierte Freigabe zu stoppen.

- Überwachen die Aktivität mit FlashGet Kids: Eltern, die FlashGet -Kinder verwenden, können durch seine Überwachungsfunktionen Sichtbarkeit in die Transaktionen ihres Kindes einbringen.

- Sie können Venmo-Transaktionen in Echtzeit beobachten, da die Benachrichtigung verfolgt wird und bildschirmspiegelung Merkmale.

- Sie können den Zugang Ihres Kindes zu Venmo mit FlashGet -Kindern blockieren.

Erziehung über Betrug: Stellen Sie sicher, dass Ihr Teenager Ausbildung zur Überprüfung von Zahlungen erhält, indem Sie sie warnen, um nicht Geld an unbekannte Personen zu senden und unerwartete Zahlungsanfragen zu ignorieren.

Die Verwendung von Venmo bleibt gesichert, wenn Benutzer sie ordnungsgemäß bewertung . Ihr Teenager kann die finanzielle Unabhängigkeit durch die Kontrolle der Eltern von Eltern von FlashGet -Kindern genießen, die sicherstellen, dass ihr Geld sicher bleibt.

Abschluss

Ist Venmo sicher? Ja, aber nur, wenn sie mit Bedacht verwendet werden. Die Unterstützung für Verschlüsselungs- und Betrugsüberwachung der Venmo besteht neben Teenagerkonten, obwohl Risiken im Zusammenhang mit Betrug und Datenschutzproblemen weiterhin bestehen bleiben. Sicherheitsmaßnahmen für Venmo-Benutzer sollten die Erstellung robuster Kennwörter sowie die Zwei-Faktor-Authentifizierung und -vertraulichkeit für Transaktionen enthalten. Mit dem Überwachungstool FlashGet Kids können Eltern die Konten ihrer Teenager überprüfen und sie daran hindern, gefährliches Verhalten durchzuführen.

Benutzer können schnelle Zahlungen über Venmo leisten, aber diese Plattform bietet keine vollständige Sicherheit. Behalten Sie ein intelligentes Verhalten auf und bleiben Sie und bleiben Sie wachsam, da das Senden von Mitteln an unbekannt -Parteien einen gefährlichen Fehler darstellt. Wenn Sie Geld an unbekannt -Einzelpersonen senden, kann es sein, ihre nächsten Betrügereien zu finanzieren.

FAQs

Das Senden von Geld durch Venmo ist eine gefährliche Praxis mit unbekannt -Benutzern. Die Plattform existiert sowohl Freunde als auch Verwandte. Senden Sie Geld nur an vertrauenswürdige Personen auf Venmo und geben Sie niemals große Beträge oder persönliche Kontoinformationen an die Nutzer unbekannt weiter.

Die Zahlungsmethode für Zelle funktioniert über verknüpfte Bankkonten, sodass beschleunigte Transaktionen für Käufer keinen Schutz bieten. Wählen Sie Zelle, wenn Sie vertrauenswürdige Personen bezahlen, während Sie Venmo für den Kauf und Verkauf zwischen Kunden unbekannt verwenden.

Das Standard -Venmo -Verhalten zeigt alle Transaktionsgeschichte an andere Benutzer an, die Namen und Benutzernamen sowie Transaktionsmengen sehen können. Durch einige Privatsphäre einstellungen können Sie die Offenlegung von Informationen auf Venmo kontrollieren. Stellen Sie jedoch sicher, dass Sie nicht mit Fremden auf Venmo abwickeln.