The digital world is here to stay. And with it comes a new frontier: financial literacy for kids. Meet the “Cash App for Kids,” a phrase that might make some people raise their eyebrows and others – nod in approval. Why? It’s a convenience that many people chase nowadays alongside monetary freedom and control over their digital lives.

With children having access to technology at a younger age, starting them on the path to financial responsibility is important. Such programs pretending to make things easier are available these days: Cash App for instance. But is it safe for our youngest users? And how can parents take up an active role in the process by using tools like FlashGet Kids?

In this all-in-one guide, let’s get into the details and discover everything about the Cash App for Kids.

Features of Cash app for kids and teens

It’s not just bill paying adults or businessmen who rely on Cash App. But it also attracts a young population, who are able to manage money and learn how to be financially responsible through this platform.

Here are some features that stand out for younger users:

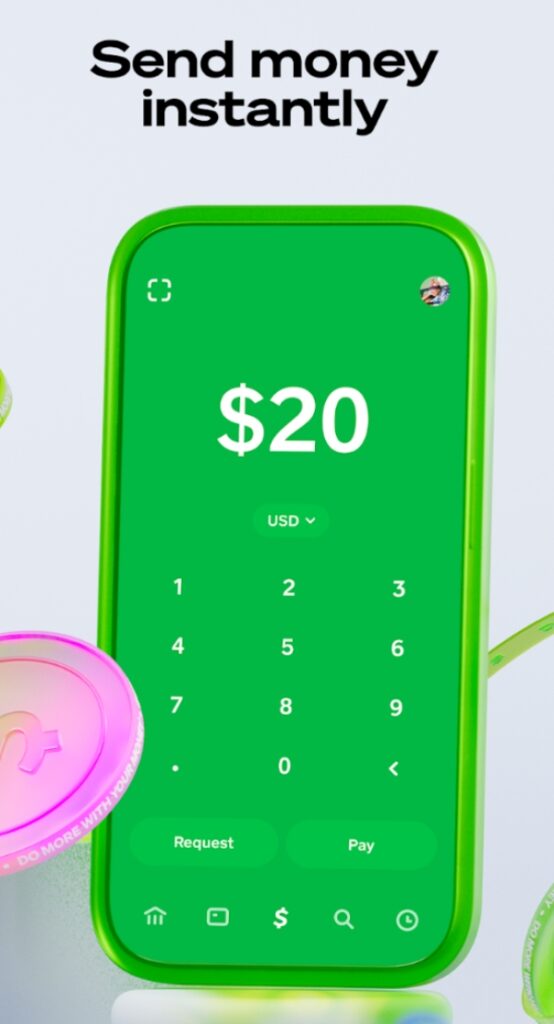

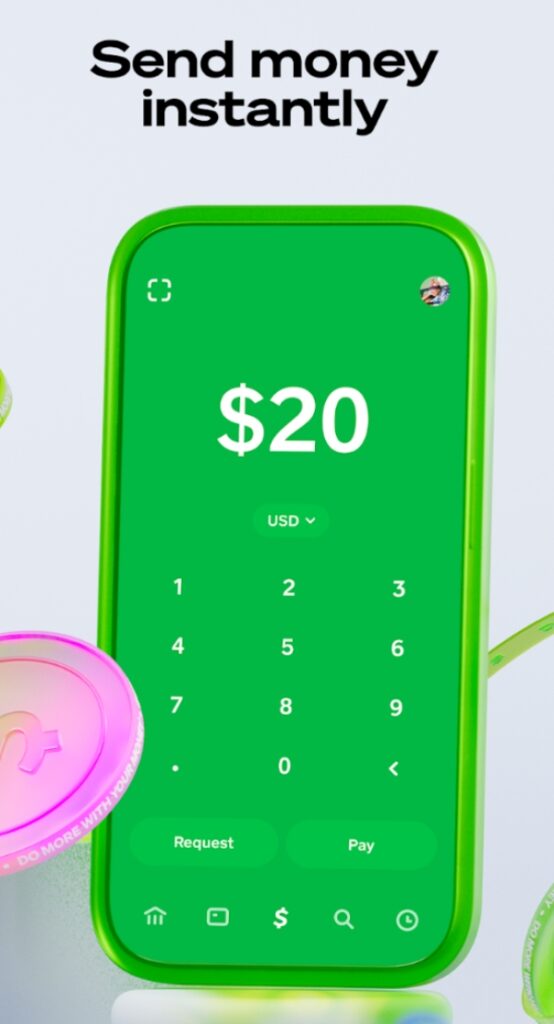

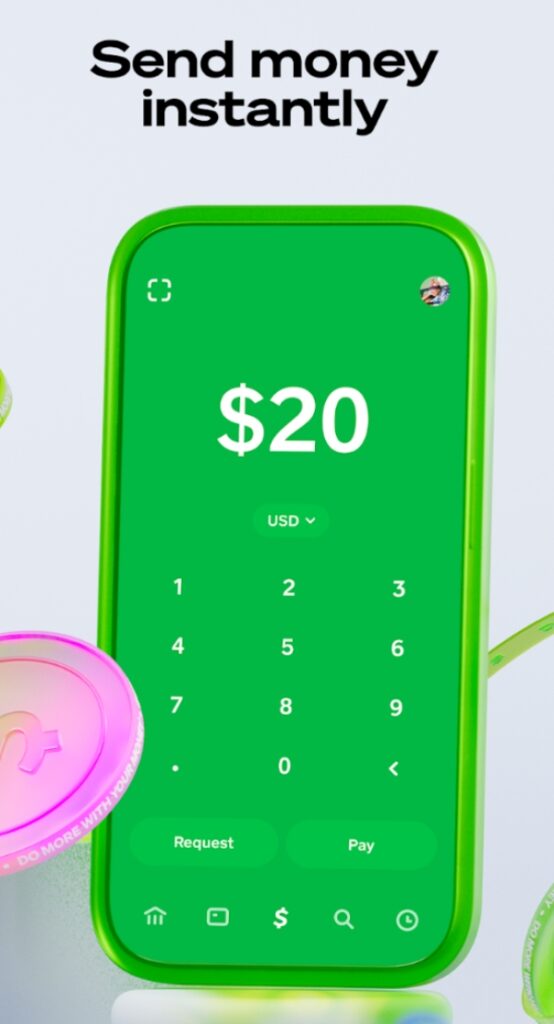

- Simple Interface. One can easily move around on Cash App for teens. This is good because it will allow even younger users to learn about it in a very short amount of time just by glancing at the layout of the page. All in all, it is most appropriate for teenagers aiming their first steps towards financial apps.

- Instant Transfers. Need to send an allowance? Or split a dinner bill? The instant transfer feature enables the fund to get to the correct destination as and when it’s expected. This is good news for America’s tech-savvy teens who appreciate the power of speed.

- Customizable Cash Card. Popular among the teenage groups, the Cash Card can be availed in different attractive prints. It’s a little thing but it’s something that goes a long way to make them feel as if they are a part of the going trend.

- Savings Goals. Planning to save for a new gadget or ticket to see your favorite band? The Cash app helps its users to save money by establishing measurable goals.

- Transaction History. The individual transactions are documented, further providing a good glimpse of how much money an individual is spending. It’s a great way for teens to learn accountability—and for parents to ask why so much money went toward gaming apps or fast food.

Is Cash app safe for kids?

Pristine safety of the financial application is the biggest concern of any parent when they think of an application for their children. Thus, can kids use a Cash App?

FlashGet Kids: Because money management starts young

Here’s what Cash App already provides to safeguard accounts:

- Data Encryption. Each transaction is then encrypted to secure data of the individuals and that of the financial solutions providers. This also helps to make the user data to be more secure.

- Two-Factor Authentication (2FA). Making it even more secure by asking for a code on the user’s phone or email usually. It is a good discouragement to unauthorized access.

- Spending Limits. A form of control is achieved where users can specify certain measures, and hence minimize spending which they might not be able to control once they embark on shopping.

Despite all these features, weaknesses exist. They are equally vulnerable to phishing scams on social platforms, which may disclose information accidentally or innocent misuse of these accounts.

The verdict? It becomes clear that the Cash App is safe for kids, so long as a child’s account is managed well by a parent. Moreover, you can improve your child’s digital security by relying on parental control solutions like FlashGet Kids.

Cash app scams: What parents should know?

Needless to say, scams are actively used in the world of digital payments today and children are an easy target. However, the increasing incidences of tricks in this application usually defies the security measures put in place by the Cash App. Quite often parents have to think a little ahead in order to shield their kids.

Here are the most common scams on Cash App:

- Fake Customer Support Scams. It is also common to find fake Cash App customer service providing fake contacts, which users share their accounts with. Many of these impersonators are likely to prey on the illiterate users for instance teens.

- Phishing Scams. There is a common scam in which a person receives an email or a text message or phone call which prompts them to call another phone number and receive free money or gift cards or other incentives. It involves children clicking on links in the website and making logins into fake apps or sites.

- Imposter Profiles. There are fake people who create fake accounts claiming to be a friend or a family member. They demand monetary transactions, they take advantage of the trust to extort money from people.

Child protection transcends simply stating rules to the child. Instead, It requires engaging with the child’s daily digital activities. Here’s how to safeguard their accounts:

- Educate About Scams. Teach children not to pay any amounts to anyone or any group even if they are from friends or contact numbers.

- Never Share PINs or Logins. Inform them that they should not give or let anyone use their account at all including friends.

- Verify Links and Offers. Promote a critical view on offers and make them understand that if something seems too good to be true, it is probably a scam.

- Use FlashGet Kids. This app can track any suspicious activity and notify parents about such behavior patterns – it is safe to say the app adds layers of protection. You can rely on its monitoring and restrictive features to ensure your child doesn’t abuse this app.

With awareness and conversation with the children, the parents can save their children from falling victims to scams. Finance is ultimately about risks and how not to get destroyed by them, which is the primary way in which financial education begins.

How to use a Cash app for kids under 13?

The minimum age to use the app is 13 but with proper supervision parents and even young children can safely use the app. Here’s how to set it up and make it work for kids under 13:

- Create a Parent-Managed Account. You may use your email address or phone number to sign up for the account. This makes sure that at every given time you are in charge of the access and usage of the data.

- Enable Parental Controls. Users can set preferences from where to buy, who to blacklist, and how much to spend.

- Set Spending Limits. Fix on the quantity of money your child should spend weekly or monthly so that they know their limits. This imparts the ability of budgeting besides curbing their expenditure.

- Teach Basic App Navigation. Again, as a parent, explain to your child how the application operates, have them practice sending, receiving money, checking their balances and history of transactions.

- Customize Alerts. Use notifications for every single transaction. It is immediate and gives you early signals that something is wrong, so that you take action right away.

- Use FlashGet Kids. This parental control fix offers an all in one fix to monitoring and restricting your child’s digital usage.

Cash App for kids under 13 can be useful if properly managed by constantly engaging and monitoring the kids. Though it has a simple and intuitive interface, children don’t require any directions regarding its safe application.

Apps like Cash app for kids

Cash App could be renowned, but it’s not the only application available for children to teach them how to be more financially responsible. But there are several alternatives developed especially for younger applicants and users. Here’s a look at some great options:

- Greenlight. Parents have a special preference for this app. This offers a debit card along with savings features, configurable spending capabilities, and other features added with teaching elements. It gets to a point where parents can even set interest rates for their children’s investments.

- GoHenry. A promising concept that combines the functionality to test primary financial material and receive financial education lessons on everyday usage. GoHenry allows children to earn their allowances on their own while learning about saving and budgeting at the same time.

- FamZoo. FamZoo can be best defined as a virtual family bank whereby parents and children work together. They can learn how to earn, save, even get a loan in a protected environment a child can understand.

- Current. Current has a very smooth touch debit card for teenagers with robust parental control. Parents can decide how much their child can spend, some merchants can be blocked and all transactions can be in real time.

- BusyKid. Instead of learning just different basic financial utilities, kids get to explore investing with this application. Through the BusyKid app,Children can select what to do with their allowance money and split it between savings, spending and the stock market.

Each app has unique features, but they share a common goal: A course which teaches kids how to manage their money appropriately. Regardless of the choice of an alternative mobile application to Cash App, it is important to focus on this sector’s safety, raise people’s awareness, and integrate the necessary information and tips for parents.

Parental control features and considerations

The goal in policing your child’s use of financial apps is not to snoop, but to ensure that your child learns how to use these apps responsibly, and safely. Although you have certain features for parental controls in Cash App, they do not go to the standard of services like FlashGet Kids.

Here’s what parents should consider when managing their child’s Cash App account:

- Monitor Transactions. Monitor every record of transaction whether big or small in amount. This lets you identify suspicious movements.

- Set Spending Limits. Put a limit to the amount of money your child can spend within a given day, week or month. It helps to instill discipline of the expenditure and also greatly discourages the spending beyond means.

- Block Specific Merchants. Block specific stores/ categories that you do not want your family to buy from or spend money with.

- Automate Allowance Payments. Deposits should regularly be made to nurture calculation and accountability on the income stream.

- Educate About Fraud Risks. Describe several possibilities of how to recognize a scam or a phishing email; explain why it is so risky to share account details.

FlashGet Kids has these features further developed into another level. Using FlashGet Kids, you can track everything your child does on their phone, especially using the cash app. If your child seems to be misbehaving or acting reckless with their money, FlashGet Kids can even help you block the Cash App for kids on their phone. So, consider FlashGet Kids as the ultimate solution when you’re trying to monitor and control your child’s digital activities.

It goes without saying, parents are able to make sure their kids become financially responsible members of society if only they continue being involved and choose the right tools.

Conclusion

The Cash App for kids: It’s a tool that can teach money management in the digital era, but safety does matter here. TSo, by integrating Cash App with other parental tools such as FlashGet Kids, you can turn one application into an educational giant.

This way children of today are not only learning when to spend. These digital bank accounts are ways in which students are learning how to save, invest and even compound. But with the proper direction, the “Cash App for Kids’ is not only safe, but wise as well.

People also ask

Idealistically, Cash App holds that users have to be of 13 years and above. Still a parent or a guardian can create a secondary account for their children under 13.

Those who have the standard subscription may cash out up to $1000 per day. This limit can be increased by giving more of your data to the app.

Not yet! Although, when used with utilities such as FlashGet Kids in mind it is quite useful for kids.