Are you facing problems in managing your family finances? Well! We understand your concerns about how difficult it is for everyone to balance bills and still save for family goals. That’s why this Truebill review proves really effective in reducing all of your financial stresses. The Truebill app provides you with full control over managing your kids’ spending or even multiple household finances.

So, keep reading this post, here we’ll discuss in detail what features you’ll enjoy using the Truebill app. Also, we’ll weigh down both its pros and cons, so you can better decide before signing up whether it’s suitable for you or not.

What is Truebill and what is it called now?

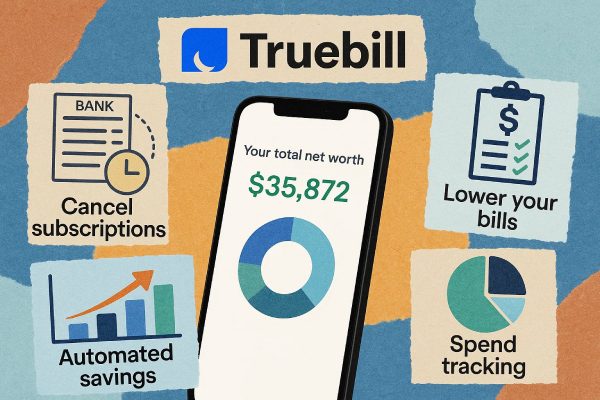

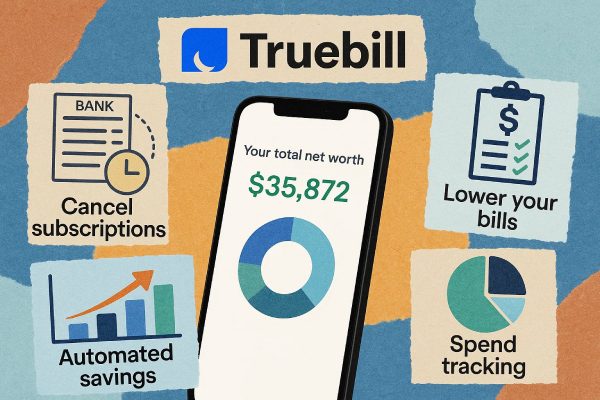

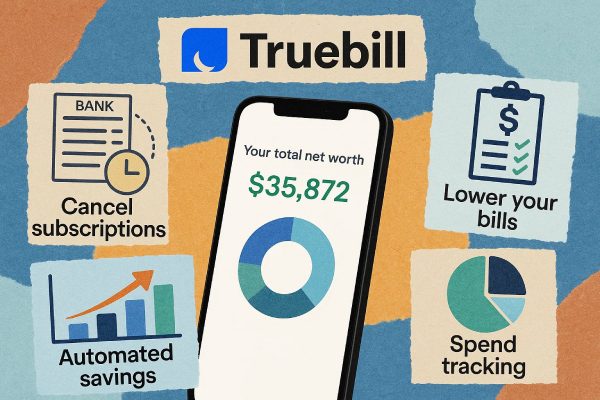

The following is the Truebill review. Truebill is actually a personal finance app launched in 2015 that allows U.S.-based users to optimize their financial habits. For instance, you’ll just link your U.S bank accounts or credit cards, and Truebill gives you full control over where money is going. Also, you can manage your recurring subscriptions and even get the benefit of tools for budgeting & savings all in one place.

You know the 3 Mokhtarzada brothers — Haroon, Yahya, and Idris- who once realized how many people unknowingly lose money because of forgetting subscription services. Thus, they came up with the idea of founding the Truebill app to empower people to best live their financial lives.

According to their 2021 press release, it had around 2.5 million members. Now, if you visit their website, you’ll find that it has almost 10 million members.

What is Truebill now called?

Truebill review: Truebill is now renowned as the Rocket Money. Actually, in August 2021, the Rocket companies (a U.S big financial company) acquired the Truebill app for about $1.275 billion.

Thus, one year later like in December 2022, they rebranded it to Rocket Money. They make this change to align it with all of their other financial services, like the Rocket Mortgage ( for home loans), Rocket Loans (offers personal loans), and Rocket Homes ( real estate service).

So, under the Rocket Money brand, it has expanded its features. For instance, formally, you could enjoy just tracking/canceling subscriptions. But now you can build your own smart budgets, and it also connects you directly with other Rocket financial services.

Key features of Truebill

Now, let’s see what features you can enjoy by deploying Truebill ( now known as Rocket Money)!

Subscription management

First of all, Truebill keeps your family up to date about the kind of subscriptions (like game subscriptions, streaming services, or app store purchases) that are currently active on your mobile. So it automatically identifies the recurring charges linked to your credit cards/bank accounts. Thus, it helps you stop paying for things that you no longer need.

Moreover, if you are a parent, then you can get an extra benefit, as you can keep an eye on what kind of subscriptions your kids are paying for. Also, you can set limits or say stop your kids from overspending or subscribing to useless services.

Bill negotiation service

Furthermore, we can all negotiate on all items we buy, but it’s very difficult to negotiate with family bills, right? But don’t worry! This app proves beneficial here too, as it may lower your monthly bills (like utility, Internet, or family insurance plan) by directly negotiating with the service providers.

Your job is just to open the Truebill app and upload any of your financial bills here; that’s all! Now, it’s the responsibility of Truebill’s team to get discounts or remove hidden fees for you. So, I must say that it’s the best for families as they can enjoy saving extra money/month. And remain free from the tension of spending a lot of time on customer service calls, etc.

Budgeting and expense tracking

In addition to the above, this app also allows you to create or manage a budget for your whole family. For instance, you would link all your multiple accounts and plan how much money to spend on what. After this, this app helps you track your spending by category.

Also, if you or even your kids exceed the planned budget, then this app instantly sends you an alert. So it keeps you on track towards your goals and also helps teach careful money spending habits.

Smart savings tool

Smart savings is one of its amazing features that makes Rocket Money distinctive. For instance, using this app, you’ll set specific savings targets like you want money for college funds, a family vacation, or even for an emergency.

Your job is done here, now this app will automatically move small amounts of money into the savings based on your budget or income.

Credit score monitoring (premium feature)

Keep in mind that Rocket Money not only allows you to manage your own budget, but as mentioned earlier, you even get loans from there. So, this app helps you monitor your credit scores, like how trustworthy you are in paying back the money. Well! That credit score usually goes between 300 and 850.

If your credit score on the app is high, then it means you pay all your bills on loan on time. Thus, it builds a good image before banks or lenders; as a result, they would trust you and give you more loans. On the other hand, if the score is low, then it would be really difficult for you to get a loan next time.

So, being a parent, you can better guide your older kids to learn the need to build a good money reputation.

Create a secure online environment for your children with user-friendly tools.

Truebill pros and cons

Do remember! You can better manage your finances via Truebill or any other platform if you understand both its strengths and weaknesses. That’s why some of its pros and cons are listed below!

Pros

- Encourages better financial habits: First of all, it provides you with details on where your money goes every month. It actually keeps you aware of your financial habits. So if you find any misalignment, then you can control your overspending or better set your budget for the next time.

- Helps you save money automatically: Moreover, owing to this app, you can easily be aware of all your subscription types. Thus ,it helps you avoid unwanted charges, and its ability to negotiate the family bills also proves beneficial in saving money.

- Offers personalized insights and tips: Furthermore, this app has the ability to track your financial habits. Thus, later on, it provides you with recommendations on how you can save your money or how effectively you can manage your subscriptions for the next time.

- Convenient all-in-one financial dashboard: Last but not least, Truebill has a very simple and user-friendly interface. For instance, you can manage multiple tasks, like tracking bills and monitoring credit scores, all from a single dashboard.

Cons

- Premium version can be costly: Although its premium version offers you a lot of advanced financial management features. But it may not be affordable for all, as its costs range from $6-$12/month.

- Service fees for bill savings: Moreover, keep one thing in mind that if this app succeeds in lowering one of your bills, then it charges a % of your total savings. Thus, it may cut off your overall benefits.

- Occasional bank connection issues: Also, this app requires you to add your bank accounts or credit card details to it. Sometimes, it may face temporary issues in syncing your bank details. As a result, you might face interruptions in updating transactions or tracking balances.

- Not ideal for complex finances: Besides all, I must say that Truebill is best for everyday users or families; it is not for managing more complex financial needs. So if you are looking for tools for investment tracking, retirement planning, or detailed tax management, then you may need a more specialized app.

Truebill alternatives: How Rocket Money compares

Now, you are better familiar with how the Truebill app is helping you manage or even optimize your finances. Okay! There are many other popular budgeting or financing applications available in the market, each having its own specificity. For instance;

YNAB ( You need a budget): It’s actually a budgeting-focused app or web browser, created by Jesse Mecham. Thus, allowing you to simplify your spending decisions, like giving every dollar a job.

Mint: Similarly, Intuit Mint ( formally known as Mint.com) was also a personal financial management service for U.S or Canada-based users. However, by March 23, 2024, this service program was shut down and consolidated all of its services under Credit Karma.

Credit Karma: It’s a free personal finance or credit monitoring program owned by Intuit that allows you to track or improve your financial health. For instance, it provides personalized recommendations for credit cards, loans, and insurance.

A brief comparison: Truebill Vs its competitors

| Rocket Money | YNAB | Mint | Credit Karma | |

| Recurring subscription detection & cancellation | ✅ Detects & cancels recurring charges (Premium) | ❌ | ⚠️ Alerts only, no direct cancellation | ❌ |

| Bill-negotiation service | ✅ Negotiates lower bills (Premium) | ❌ | ⚠️ Limited via partners | ❌ |

| Budgeting & expense-tracking tool | ✅ Custom budgets, spending & net worth tracking | ✅ Very strong zero-based budgeting | ✅ Basic budgeting, fewer custom options | ⚠️ Basic budgeting/expense tracking, but less depth than others |

| Smart/Automated savings goal tool | ✅ Automates savings goals | ⚠️ Manual goal-setting | ⚠️ Basic savings goals | ❌ |

| Credit score / net worth monitoring | ✅ Credit & net worth tracking (Premium) | ⚠️ Less emphasis on full credit monitoring | ✅ Free credit score & alerts | ✅ Strong: Free credit scores, full credit reports & identity monitoring |

| Pricing/business model flexibility | Free tier + Premium choose within a range | Paid subscription (e.g., ~$14.99/month or ~$99/year) | Free (ads) + optional Premium | Free to use — revenue via product referrals |

Conclusion

In summary, Truebill ( now Rocket Money) is overall a practical choice for families to manage their financial habits. For instance, whether you want to manage subscriptions, monitor overall household expenses, or set spending limits for children, this app proves to be an easy-to-use all-in-one solution.

Moreover, Rocket Money is continuously adding new features like smart budgeting tools and even better family account control. Thus making it even more effective for families in the future.