Financial literacy has always been an issue when you’re talking about teenagers. All they know about is having fun and blowing up their money on pirates. However, these habits carry over in later years of their life, when they have a bad credit score and no savings. This situation can set them back a lot, especially after college. Luckily, many teens have recognized this issue and started using investing apps to educate themselves. If you’re also looking for the best investing apps for teens, keep reading. Hopefully, you’ll find a tool to help you better manage your finances in your teen years.

Why teens should start investing early

There is no such thing as being too young when investing. You might have heard the quote, “The best time to invest was yesterday; the next best time is Today.” Starting early (as teenagers) yields many financial benefits. The following details will further expand your understanding.

- Financial literacy: Even if teens don’t have much money, learning how to manage it can help them avoid many losses. They can learn about the basics, like stocks and bonds, while also learning how to diversify their capital to minimize risk. This behavior helps them avoid common financial mistakes when accessing “adult money.”

- The beauty of compounding interest: This principle’s significance allows teens to grow their capital exponentially by starting early. Even if a person has a couple hundred bucks, it can grow significantly over the years. This substantial sum can then help teens later on as they settle down or have to put a down payment for a house.

- Exposure to the market: Growing wealth isn’t the only reason to encourage teens to invest early. Instead, these kids learn about market trends and how to take advantage of different tax accounts. These habits can then pay dividends when they start to earn real cash.

All in all, there isn’t any downside to investing early. With financial freedom, you can realize your wildest dreams without worrying about your next paycheck. So, consider getting into the investing game and learning how to manage your cash.

Key features to look for in investing Apps for teens

Over the past couple of years, many financial apps have hit the market. When you’re looking for the best investing apps for teens, you need to first set criteria. Here is what we use to judge if an investing app is worth your time.

1. Interface:

The first feature you need is a user-friendly interface. If the app is cluttered, you’ll barely be able to learn anything. So, find an option that has a simple yet functional interface. There shouldn’t be any massive text blocks within the app, and everything should be sorted into sections on the home screen.

2. Educational resources:

The application should include short courses on each investing topic. Reviewing video guides and articles can help you understand intricate concepts like investing strategies. So, find an app that offers sufficient educational material.

Teens often ignore basic investing strategies or get overconfident when using investing apps, and they will sometimes spend too much money. So, the ideal investing app should offer parental controls to limit and regulate a teen’s behavior.

4. Low fees and minimums:

Lastly, the teen investing app shouldn’t focus on ripping off teens and should have low fees and minimums. That way, you won’t have to risk too much money on a single investment opportunity and can keep most of your profits.

Top investing Apps for teens sharing

Stockpile

Stockpile allows teens to buy fractional shares and offers gift cards for stocks, making investing easy and fun. It’s perfect for beginners with minimal funds, helping them start their investment journey with small amounts.

Features:

– Fractional shares.

– Gift cards.

– Educational resources.

Pros:

– You can enter with small capital.

– The interface is pretty easy to navigate.

Cons:

– The fees aren’t that cheap.

Bloom

Bloom combines gamified financial literacy with strong parental controls, providing teens with an engaging and educational investing experience. Its goal is to make learning about finance enjoyable and safe.

- Features:

- Earning goalsFinancial summaries

- Step-by-step lessons

- Pros:

- Decent parental controls

- Cons:

- Doesn’t offer any advanced trading options.

Greenlight

Greenlight integrates banking and investing in one app, offering a debit card and strong parental controls. It’s a comprehensive financial tool designed to help teens learn about money management and investing.

Features:

– Chores and cash management.

– Instant money transfer.

– Savings goals.

Pros:

– It focuses on building discipline in kids.

Cons:

– Customer support can be a bit lacking.

Busykid

Busykid links chore management with investing, teaching teens the value of earning and managing money. Parents can oversee investment activities, making financial education practical and interactive.

- Features

- It offers a comprehensive rewards system.

- Helps kids browse different stock options.

- Comprehensive parent dashboard.

- Pros

- Each activity has to be approved by the parents.

- Cons

- It only offers the basics of investing.

Acorns

Acorns automatically invest spare change from everyday purchases, allowing teens to start small and grow their portfolios. Its diversified portfolios and low minimums make investing accessible for beginners.

Features:

– Earn bonus investments.

– Custom debit cards for kids.

– Courses and detailed videos from countless experts.

Pros:

– Low barrier to entry.

Cons:

– Some concepts and courses can be a bit tricky for kids.

Schwab Mobile

Charles Schwab offers a fee-free, robust platform with extensive investment options, ideal for older teens. It provides various financial tools and educational resources to deepen investment knowledge.

- Features

- Multi-layered security.

- Podcasts and investing articles from experts.

- Complete investment and accounts tracking.

- Pros

- Suitable for serious investors and higher capital.

- Cons

- The advanced tools can be overwhelming.

Stash

Stash lets teens invest in fractional shares and offers educational content with personalized guidance. It’s a comprehensive tool for learning about and starting in the world of investing.

Features:

– Assisted investing.

– Access to diversification score tools.

– Integrate community with market experts.

Pros:

– Users can access personalized investment advice.

Cons:

– You’ll have to pay to get access to all its features.

Fidelity Youth

Fidelity Youth Account provides a fee-free investing platform with strong educational tools supported by Fidelity’s reputable brand. Parental involvement ensures a safe and informed investing experience for teens.

- Features

- Access to baskets of stocks and ETFs.

- Learn and earn programs.

- Protection guarantee.

- Pros

- There aren’t any fees or minimums you have to worry about.

- Cons

- The interface is a bit tricky.

IBKR Mobile

Interactive Brokers offers low fees and advanced tools, making it suitable for older teens ready for sophisticated investing. It’s designed for those with a higher level of financial understanding.

Features:

– Access to demo accounts for beginners.

– Access to all forex and stock trading options.

– Minimum commissions.

Pros:

– There are many advanced tools for serious investors.

Cons:

– It requires advanced financial knowledge.

Ally Invest

The Ally Invest platform is very friendly, with no account minimums. The app is perfect for teens who are getting into investing for the first time. Low charges make the journey easy and straightforward, while simple navigation makes investing straightforward.

- Features

- One-stop payment solution.

- Helps track spending habits and deposits.

- Offers a ton of investing options.

- Pros

- Their interface is amazing.

- Cons

- No parental controls.

Prevent some unsafe investment apps from appearing on children’s phones by FlashGet Kids

While all the previous apps are great in their assistance in letting children learn about managing their own finances, there are also lots of risky ones in the market. Kids can download apps like Robinhood and waste all their money on different trading options. The given behavior strips off the existing financial literacy of a child and pushes him towards gambling on different stocks. So, you would resort to a parental control app like FlashGet Kids.

Features introduction:

FlashGet Kids is a one-stop parental control solution that can help you keep your child away from risky investing apps. There are several features within this tool that restrict and monitor a kid’s mobile phone. Here are some features that stand out the most:

This tool within FlashGet Kids will help you see whatever is presented on your child’s phone screen. If you find your child spending too much time on a risky trading app, you can intervene right away. From there, you’ll have to educate your child about money management.

If your child is already addicted and won’t stop testing different investing apps, then you can use the app blocker tool in FlashGet Kids. This tool will stop your child from opening any investing app you’ve blocked remotely.

Activity tracker:

FlashGet Kids also offers an activity tracker to help you see how much time your child spends on each app. This feature within FlashGet Kids makes it effortless to figure out if your child is addicted to a gambling app disguised as an investing app.

Using tutorial:

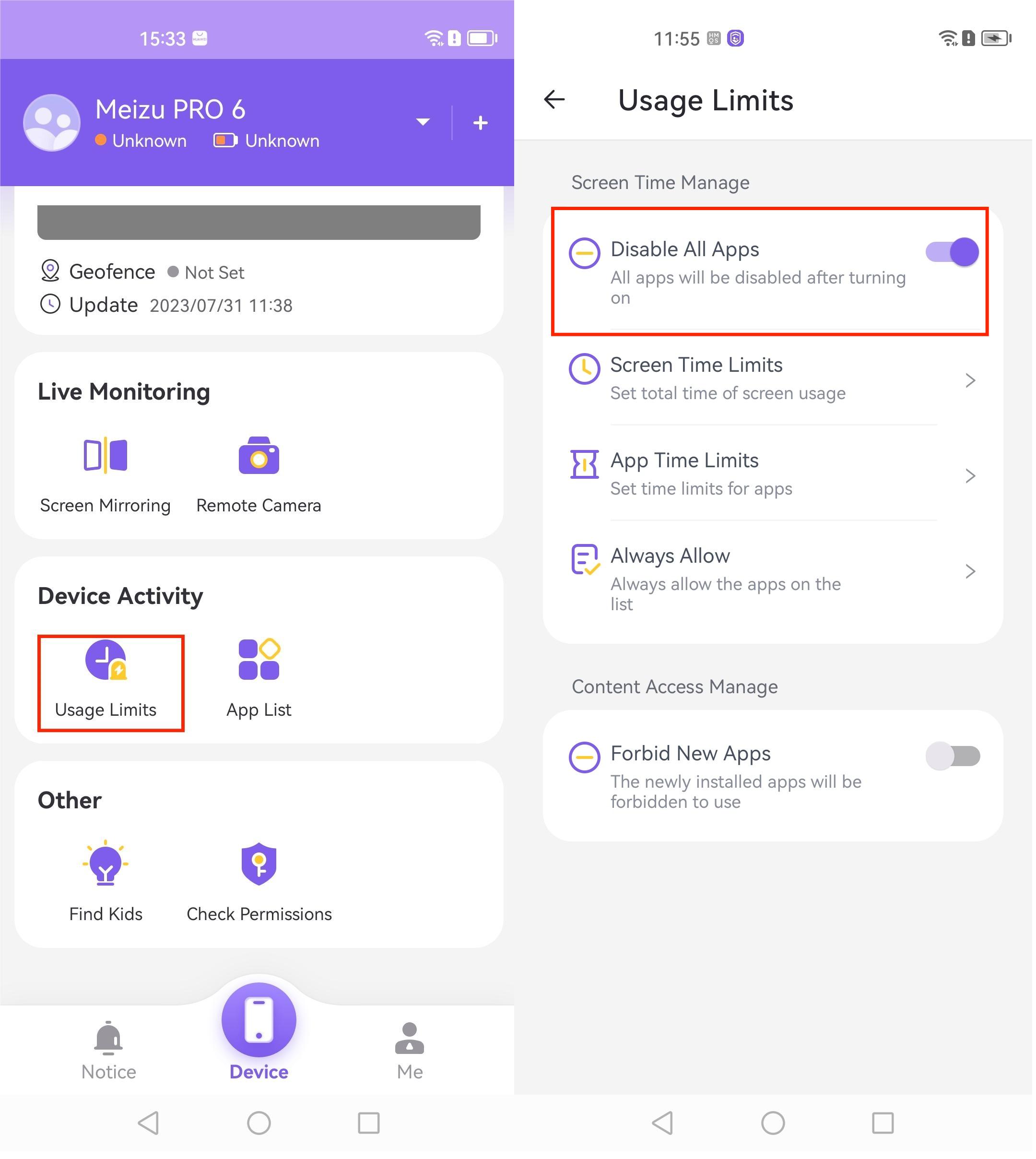

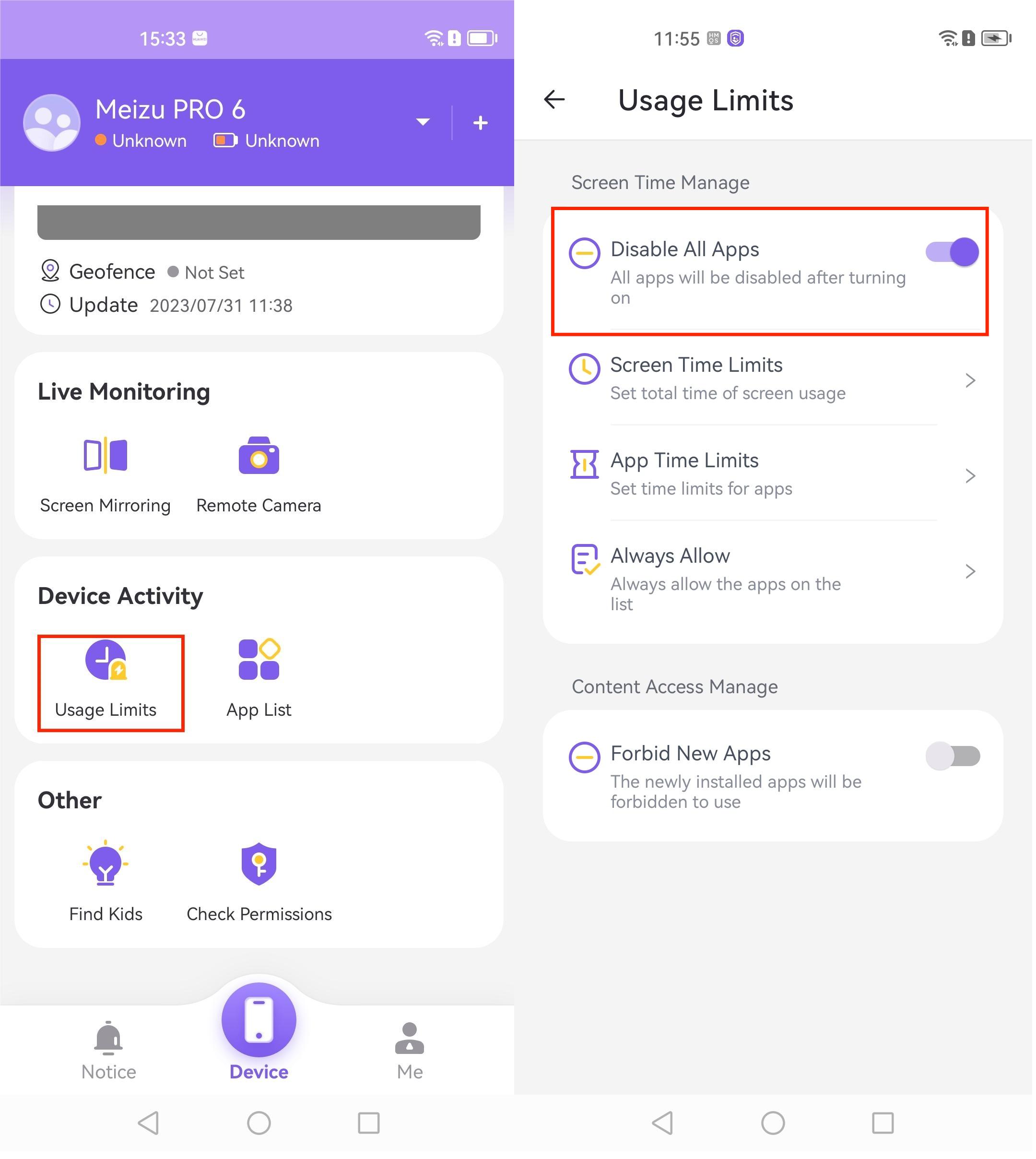

Now that you know how FlashGet Kids can help you keep your child safe, let’s discover how you can set up this application.

1. Download and install FlashGet Kids on your phone.

2. Create an account.

3. Download and install FlashGet Kids on your child’s phone from their phone browser.

4. Bind both apps together.

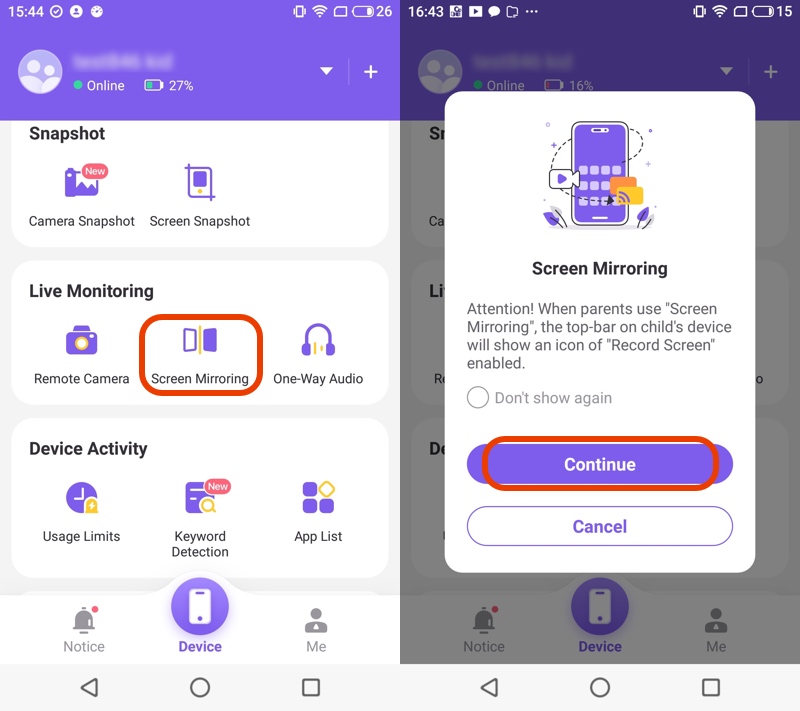

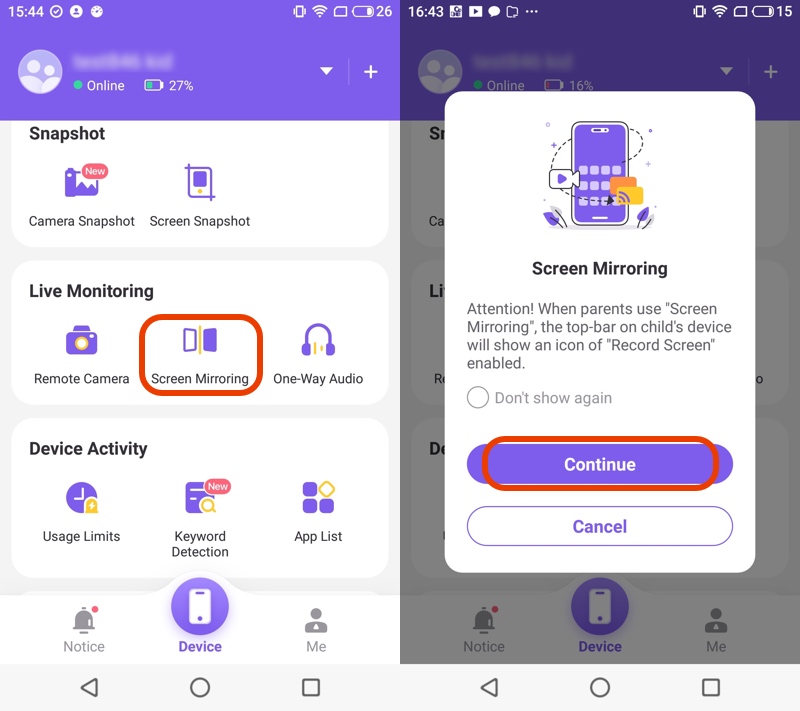

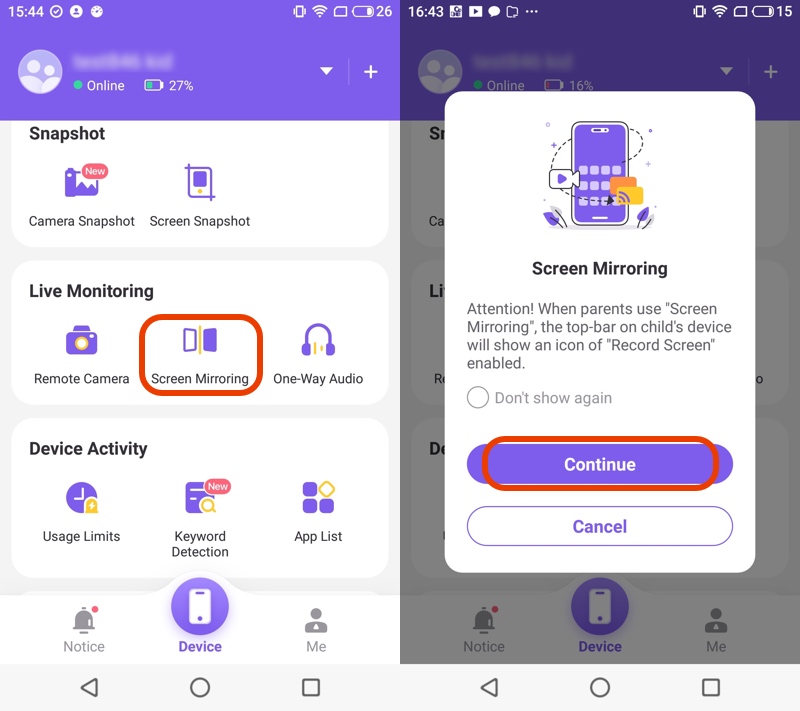

5. Open the parental control app on your phone and go to the live monitoring section.

6. Tap on screen mirroring to see what your kid is doing on their phone.

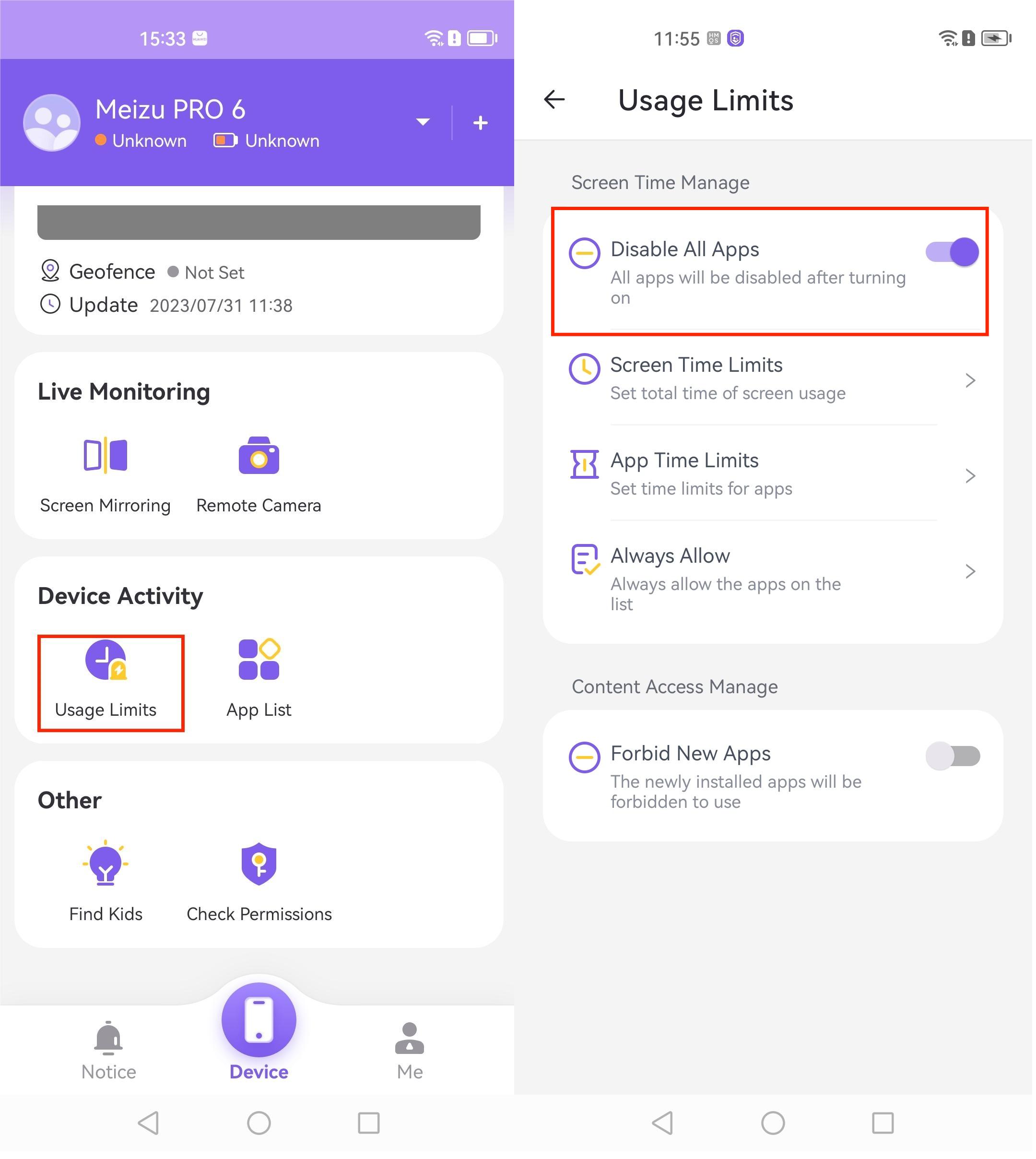

7. Go to the app blocker section next to block any malicious app you find on your child’s device.

Conclusion

Investing in apps can be great for making your child financially literate. Learning money skills will put your child ahead of the competition by a long shot. Moreover, your teens can benefit from compounding interest if they invest early. So, consider using some of the investing apps for kids listed above. Those options are great and offer decent educational content to the users. Moreover, if you’re skeptical about your teen getting out of hand, you can rely on parental control tools like FlashGet Kids. This tool will give you all the control you need to keep your child in line.