With each new technological enhancement, financial services have also become more effortless and accessible, and Venmo software is one of them. It allows you to send and receive funds with little to no effort. But in today’s world, this ease and convenience come with some problems, especially for teens. So, as a parent, navigating the balance between your teen’s financial autonomy and protecting their online privacy poses a unique set of challenges. That’s why, in this guide, you’ll learn how to set up Venmo teen account, its management, and how to monitor a Venmo account for teenagers so that you can make informed decisions.

Can teens have a Venmo account?

If you’re a teen thinking about using Venmo, I’m afraid you cannot because this app usually doesn’t allow anyone under the age of 18 to create an account. Thus, I must say that it is for adults who can legally manage finances.

In order to set up a Venmo account for teens, you need to possess a U.S phone number along with a bank account or card registered in your name. Attempting to use a parent or guardian’s information constitutes account fraud under Venmo’s policies and could result in the account banning issues.

If you want to buy something or need to transfer some funds, a parent or guardian would be the best to help facilitate the transaction. The guardian can use their own account, which makes it safe and compliant.

Real-time supervision means you never miss what matters.

How to set up a Venmo teen account?

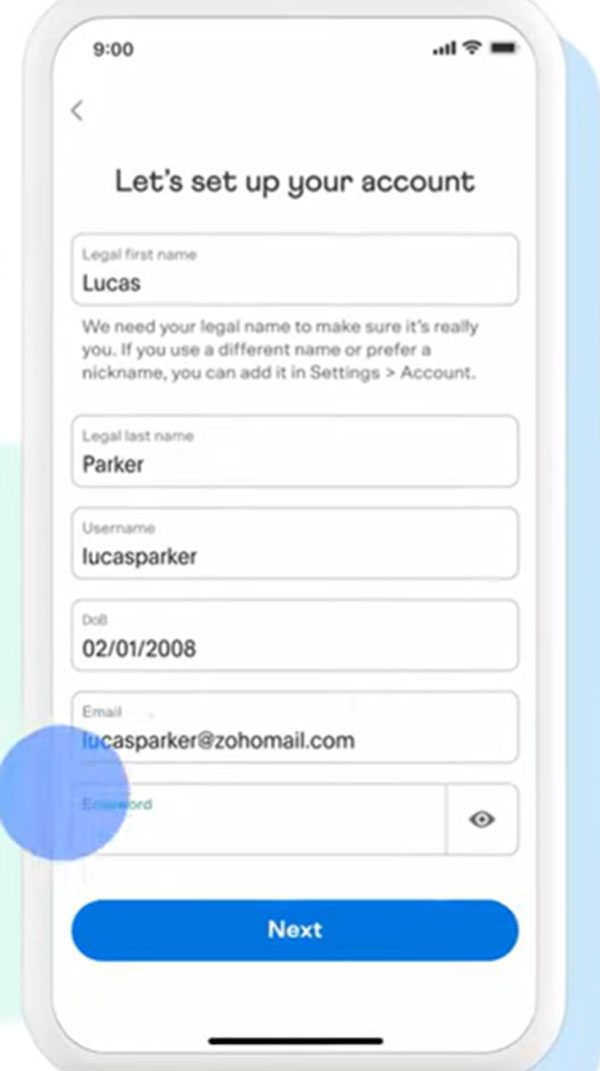

Establishing Venmo for teenagers is both easy and safe. However, if you are between 13-17, then your parents or guardians will need create an account for you. Here, we have put together simple steps that you need to follow.

Step 1. As a parent, check to see that you have an active Venmo account. If so, open the app on your mobile device. If you don’t have an account, simply go to the App Store or Google Play to download the app and create an account.

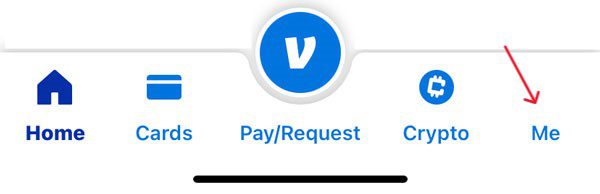

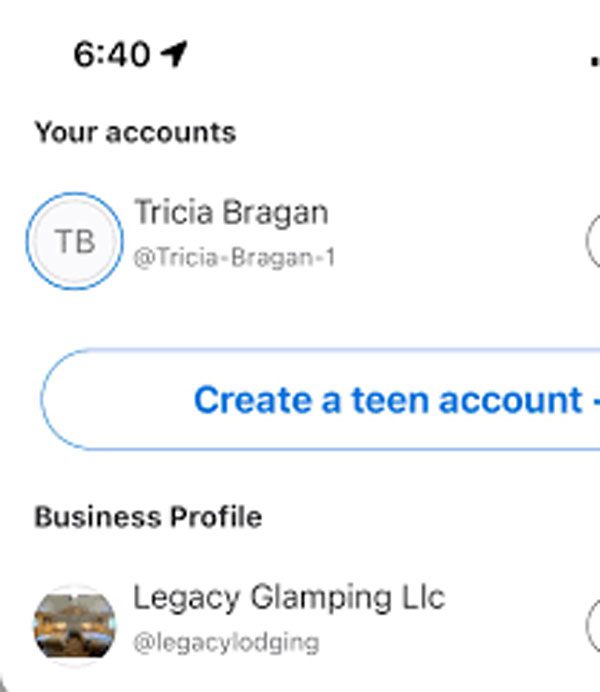

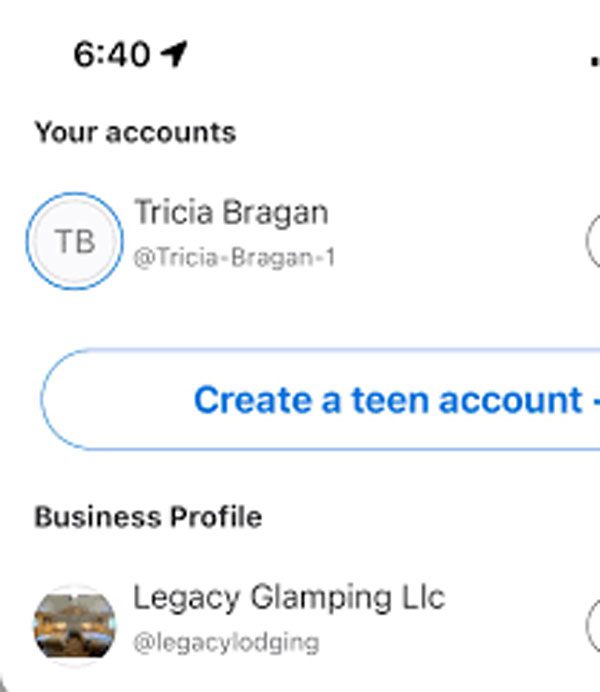

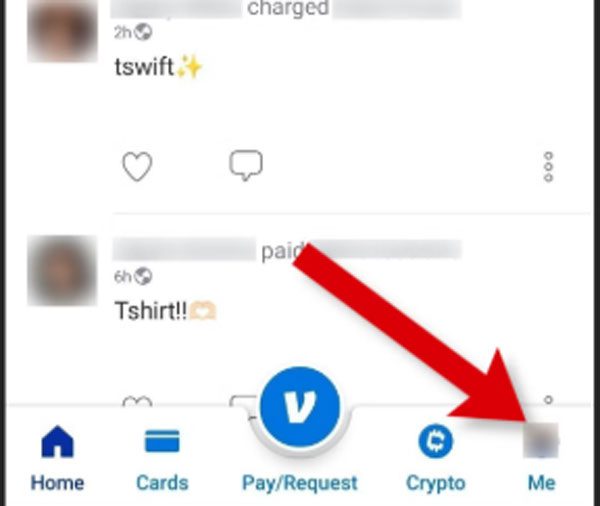

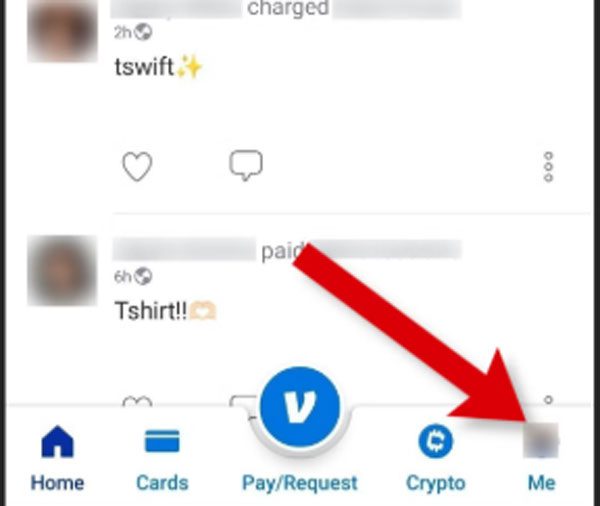

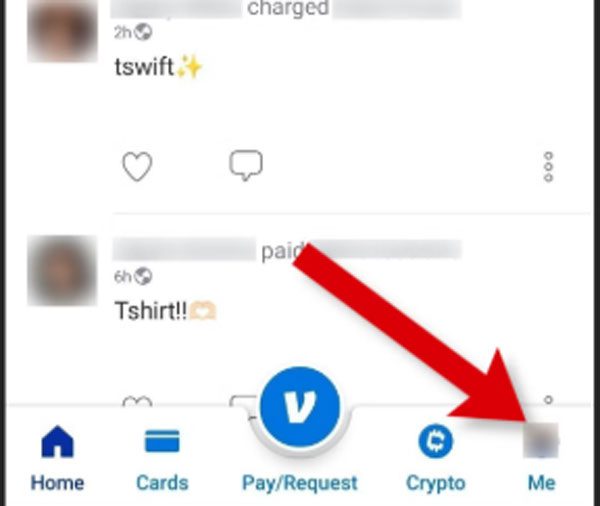

Step 2. Press the “Me” button located at the bottom right corner. From there, tap on the small triangle next to your name located at the top.

Step 3. Next, select “Create a Teen Account,” followed by a click on “Get Started.”

Step 4. Here you can select their preferred vibrant color for Venmo Teenage Debit Card. Select any option and press “Next.”

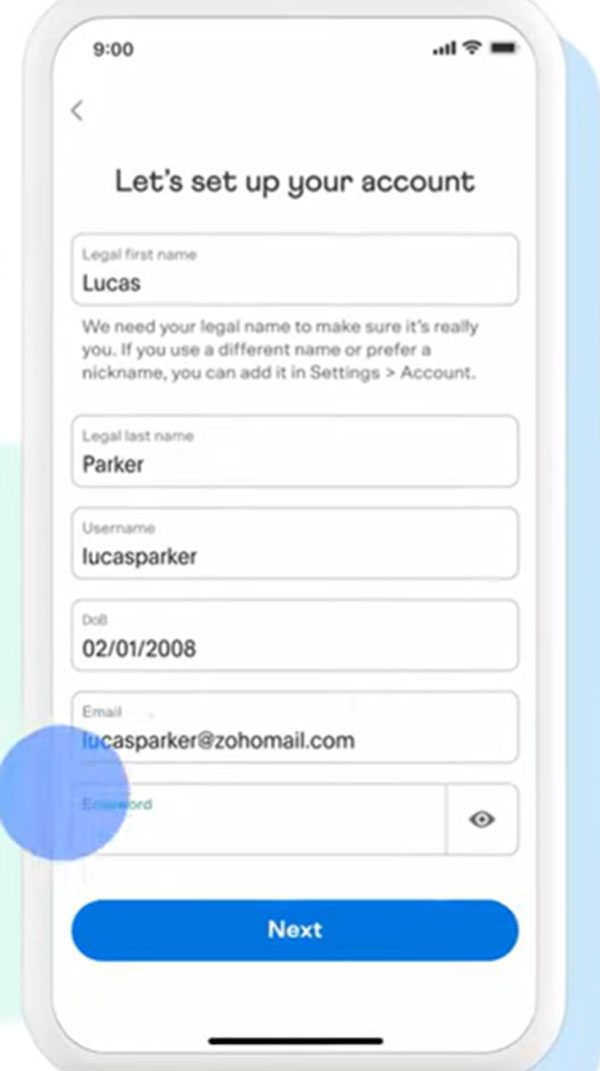

Step 5. At this stage, you need to provide the teenager’s full name as well as an accurate date of birth. This is to confirm they fall within the appropriate age and are accurately identified.

Step 6. If you want to fund the account, select that option at this moment. Alternatively, if you want to do this later, simply click on “Skip.”

Important things to note

- A parent or guardian must possess an active Venmo account.

- You must provide the teen’s full legal name and date of birth.

- It doesn’t collect Social Security numbers from teens.

- It requires a postal address from the United States for the shipment of the debit card.

Securing the account

- As soon as you set up a teenage account, ensure activations of all security options. These options will help safeguard the teen’s finances, identity, and personal details.

- Enable Notifications: This feature would help you by sending alerts for each and every transaction immediately.

- Enable login security: You may also use Face ID, a PIN code, or biometrics to create an additional barrier for payment lock.

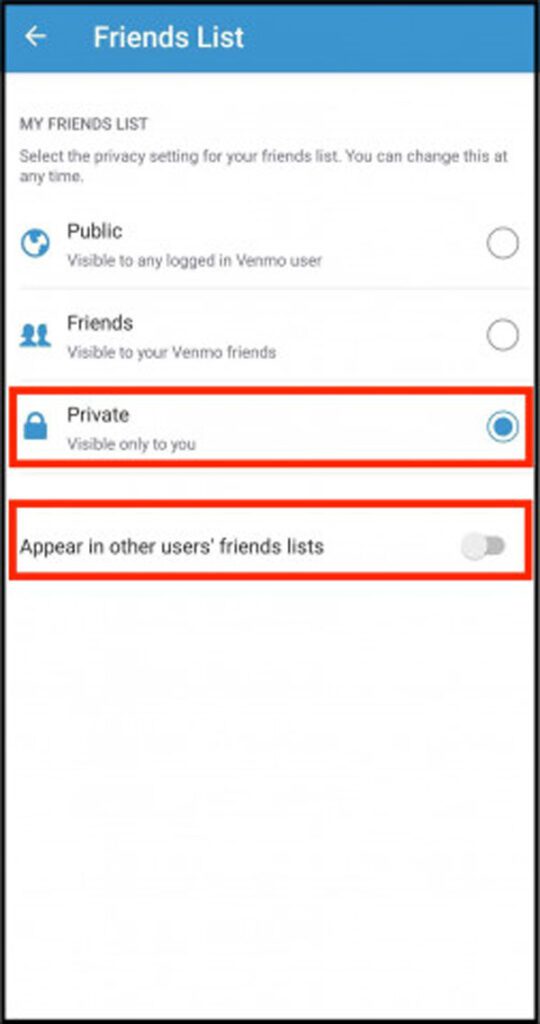

- Change Privacy setting to Private: With this adjustment, only the user and the person he/she is paying to or paying to him/her will be visible with respect to payments shared.

How to delete a teen Venmo account?

If you need to remove a Venmo account for a teen, then you are in luck, as it is very straightforward.

Step 1. The first step involves opening the app and logging into your Venmo account.

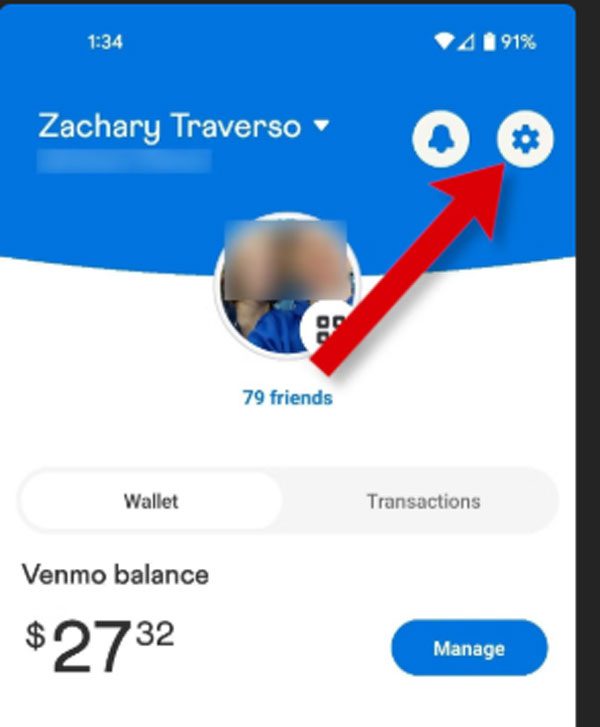

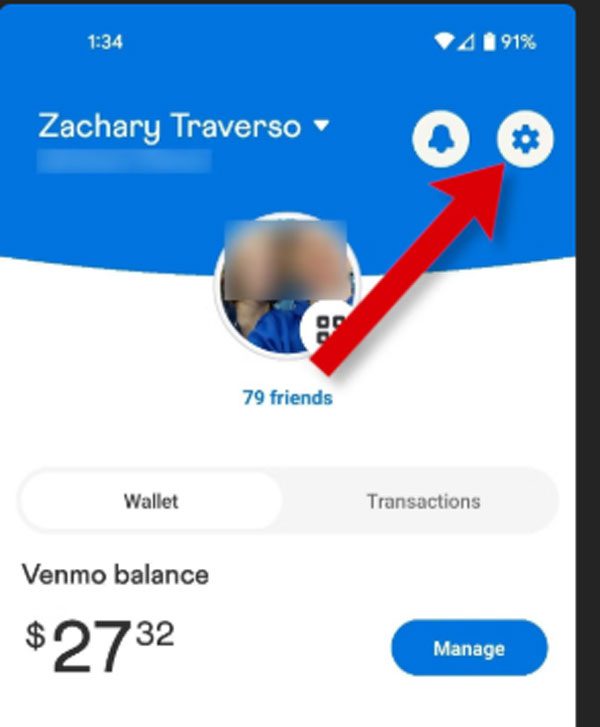

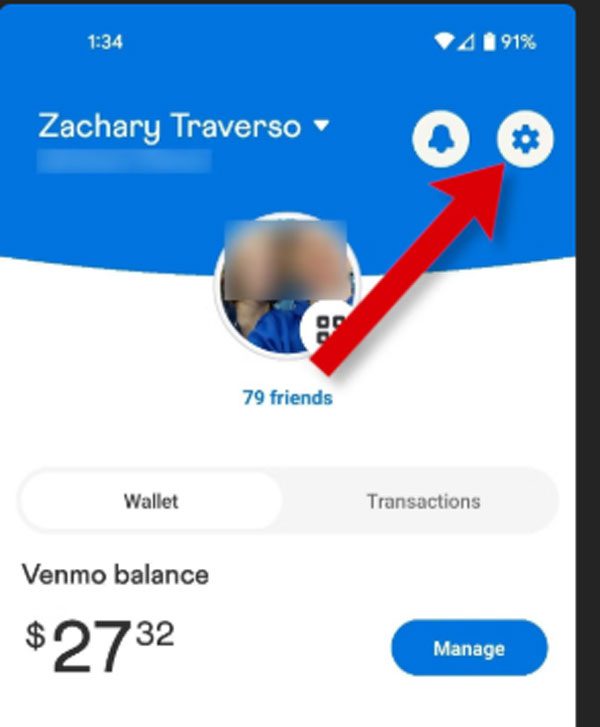

Step 2. Now, click on the Me icon which is usually located in the bottom right corner of the app.

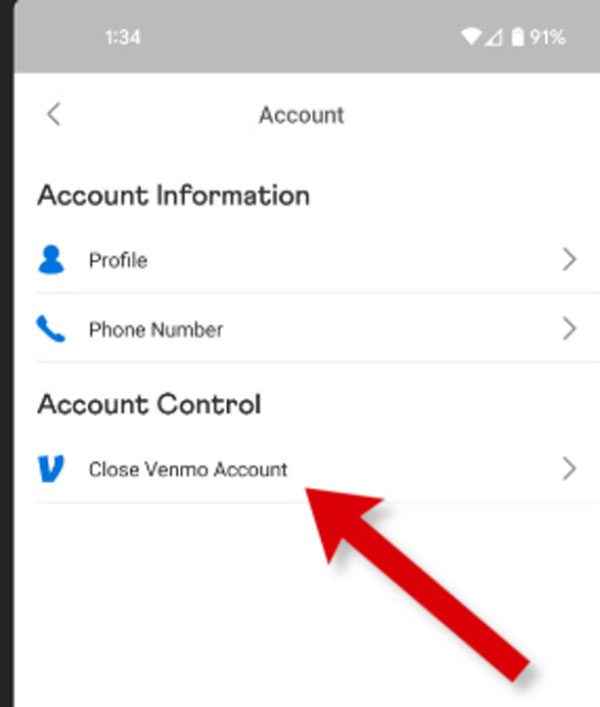

Step 3. Now, to access settings, click on the gear icon located at the top right corner.

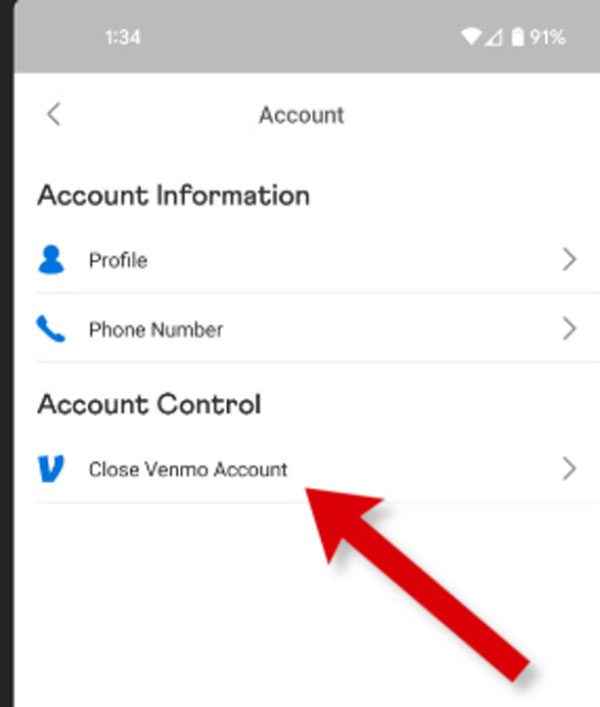

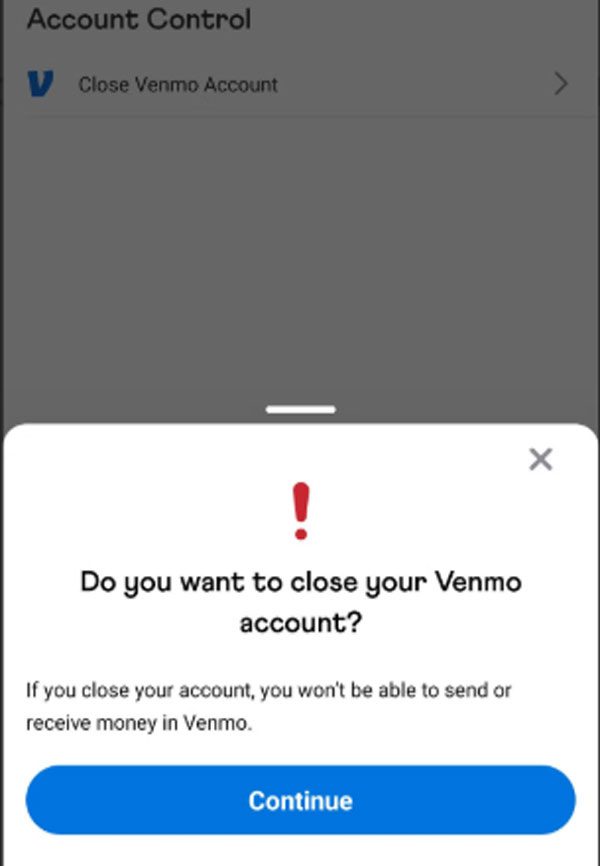

Step 4. Now, scroll to the bottom and select Close Venmo Account under the Account tab.

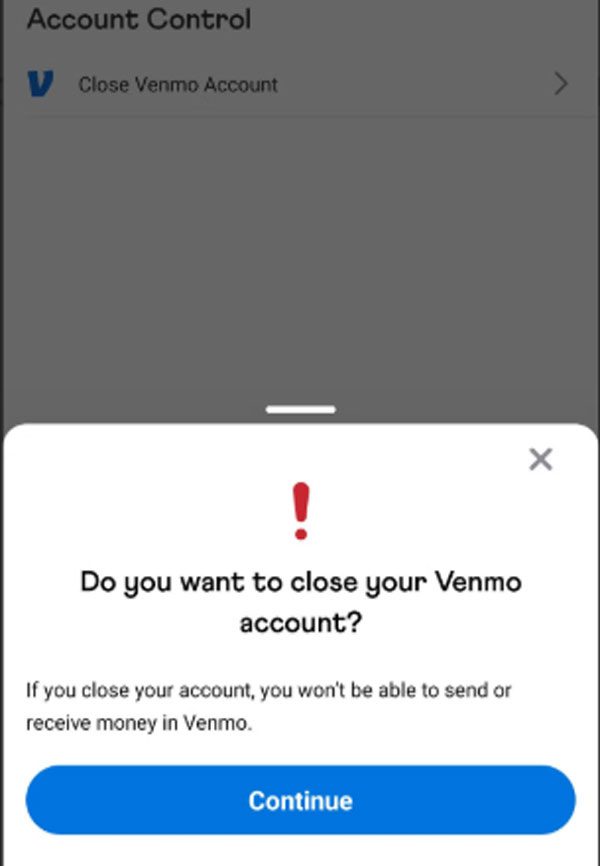

Step 5. You will get notified that you need to confirm the associated debit card deletion. If you confirm, the account will instantly get closed and the debit card will become inoperable.

Important things to note

- Only a parent or guardian can delete the Venmo teenage accounts.

- All remaining funds will automatically get transferred to the Venus primary balance held by the parent.

- The teenager should physically shred the card after disposing of it.

Is a Venmo teen account ok for kids?

If you’re considering whether a Venmo account is suitable for your children, it’s worth examining the advantages and disadvantages. So let’s take a look!

Potential fees and their impact on teenagers

At this moment, Venmo does not impose a monthly account servicing fee for teenagers. However, there are a few costs which you may want to track.

- Withdrawals via ATM: If your child possesses a Venmo Debit Card and wishes to withdraw cash using an ATM outside the Venmo Network, there is a fee of $2.50.

- International Transactions: If your teen sends or receives money from someone outside America, there may be additional costs.

- Instant Transfers: In addition, transferring money will not incur any cost, but instantly transferring the funds to the bank account will have a fee of 1% with a minimum charge of 25 cents.

With the outlined payment restrictions, it is clear that tracking payments is time-critical for budgeting, managing finances, and scheduling.

Guidelines for Venmo Responsible Usage

To promote the sensible use of Venmo for your teenagers, below are a few pointers that you have to follow!

- Set a Budget: Understand that only you as a parent can shape the spending habits of your kid. Thus, instilling clear guidelines for them will empower them to budget smartly.

- Track Payments: You should track spending as it will help monitor activity within their accounts.

- Only Pay Trusted People: Teach your children that they should pay only to their friends and family because payment fraud is quite common today.

Active safety features to protect young users

Venmo has some features built into the platform to help protect your teens from scammers. These include;

- Transaction Monitoring: They can also enable you to monitor transactions and payments that go through your teen’s account, allowing them to filter adult supervision.

- Send Payments Remotely: This option allows parents to send money from the child’s account.

- Adjusting Settings: If you want to ensure that only your teen’s friends can view their transactions, set the account to private. This also prevents strangers from viewing personal information.

Overall, it is clear that Venmo can improve a teenager’s financial literacy. However, parents must ensure active supervision to find the middle ground between allowing control and implementing safety measures.

How can parents ensure their teen’s Venmo account is used Safely?

As a guardian, you might be wondering about your child’s financial safety on apps like Venmo. While Venmo does provide some transaction oversight, it likely doesn’t meet your full supervision needs.

This is exactly why the FlashGet Kids parental control app can help you a lot. With this app, supervising and protecting your teen’s finances becomes easier as it goes well beyond other systems when it comes to monitoring their digital activities.

- Screen mirroring: With the FlashGet Kids Screen mirroring feature, parents would have unparalleled visibility into their teen’s online spending and payment activities.

- Usage report: Moreover, you will also see how much time your kid has spent on the Venmo app on a daily basis.

- Notification tracking: FlashGet Kids also allows you to see instant notifications from your kid’s phone. Thus, you can easily configure alerts for each transaction on apps like Venmo.

- Snapshots: using this feature, you can get real-time images of your kid’s phone screen. Thus, if you find any suspicious activity, then you could use these images as proof.

Alternatives to Venmo for teenagers

If you’re seeking different platforms for teenagers that are easier to use than Venmo, just relax! as there are several options available.

i) Apple Cash Family

- Price: Most transactions are free.

- Applicable age: 13 to 17 years old ( approved by a guardian)

Through Apple Cash Family, parents can create a virtual account for their children which allows them to buy items from the app store or their family Apple account. Moreover, parents are able to monitor their tweens’ hands and curb their spending.

ii) Google Pay

- Price: No fee for sending money to friends.

- Applicable age: 13 years and older with guardian approval.

Google Pay enables teens to make payments or send money to their friends via their Google accounts. Transactions are visible to parents and therefore, they can set up controls which is a positive aspect for guardians.

iii) Greenlight

- Price: $4.99 a Month (for Basic Plan)

- Applicable Age: 6 to 18

The Greenlight debit card seeks to help children and teens aged 6 to 18. Parents are able to set spending limits, track their child’s spending, and even set allowances. Furthermore, it helps teens learn to manage money which makes it suitable for younger users.

iv) Chase First

- Price: None

- Applicable Age: 13 and older with guidance from parents

Chase First provides a debit card and online banking access with no monthly fee. During the first month, parents can track their teen’s spending alongside setting alerts which adds an extra layer of safety. Keep in mind that this account works well for families who already bank with Chase.

v) Capital One MONEY

- Price: None

- Applicable Age: 8-17 (with adult supervision)

With Capital One MONEY, a teen checking account with a debit card is usually offered at no charge. Moreover, parents can restrict the spending on the card as well as view transaction history.

Conclusion

In summary, we analyzed how teenagers interact with Venmo, discussing its age requirements, registration processes, and even how you can delete accounts. As for younger audiences, it is crucial that their parents fully utilize the privacy features available on Venmo to restrict and control their teen’s engagement on the platform. For true supervision, however, FlashGet Kids provides a more robust solution. With this app, you can see in real time what your child is doing on Venmo, eliminating any uncertainty.

FAQs

Children younger than 18 years of age cannot have a personal Venmo account. However, children aged 13 to 17 may access Venmo with consent and supervision from a guardian through a special Venmo for Teens account.

If you use Venmo without authorization prior to turning 18, then your account will ban permanently. So, you must be 18 years or older,” and in this case, minors would need to ask an adult to proceed.

Two personal Venmo accounts are largely banned. Each person must have one personal account on Venmo. However, you may hold a personal account and a business account, granted the latter one usage in proper contexts.