As you know, in today’s digital age, more and more people are starting to use mobile applications to manage their finances. The app store is filled with a wide variety of readily available financial apps. Among them, Cash App stands out for its user-friendly interface and versatile features. However, with its growing popularity, certain concerns regarding its safety and suitability for youngsters have arisen. This article provides a comprehensive analysis of Cash App reviews, its safety, and parental controls. I will carefully dive into the functionalities of Cash App, its pros and cons, and offer my insight into how parents can monitor and control their children’s usage of the app.

What is the Cash app?

Cash App was developed by Block, Inc. (formerly known as Square, Inc.) It is a mobile payment service that allows its users to send and receive money, pay bills, and invest in stocks and cryptocurrency. It was launched back in 2013. As mentioned earlier, it gained widespread popularity thanks to its simplicity and the range of financial services it offers. Its users can easily link their bank accounts, debit or credit cards to the app and use it for their day-to-day transactions. Cash App also provides its specialized physical card that can be used to withdraw money from ATMs or make purchases at stores.

Pros and Cons of Cash App

Pros:

- Ease of Use: This app has a very intuitive and user-friendly interface that simplifies otherwise complex financial transactions with a few taps on the screen. This feature makes it suitable for users of all age groups.

- Instant Transfers: Through this app, you can instantly transfer funds with minimal transaction fees.

- Versatile Payment Options: As mentioned earlier, this app supports linking various bank accounts, debit and credit cards making it a one-stop app for all your financial needs.

- Investment Opportunities: Cash App offers options to invest in stock and cryptocurrency directly through its channel.

- Cash Card: Cash App also offers its physical card if a user requires it. It can be linked to the app and be used to withdraw money from ATMs or make purchases.

- Boosts: Cash Card users get discounts and cashback offers from their partnered stores and restaurants.

Cons:

- Limited Customer Support: The customer service of Cash App is very limited as users can only communicate through email and chat. There is no phone call support which can sometimes prove to be quite frustrating for urgent matters.

- Fees for Instant Transfers: They charge 1.5% for instant transfers which can pile up over time.

- Limited Protection: Cash App has fewer security measures in place regarding their transactions as compared to competitors like PayPal which makes it a tad more risky.

- Security Concerns: Like other online apps, it is susceptible to fraud and scams. Some speculate that it can also be used to launder money for criminals.

- Age Limit: This app is restricted to users aged 18 and above.

Is Cash App safe to use?

Cash App uses various security measures to protect its users. It uses a technology called encryption which is the process of converting information or data into a code to prevent unauthorized access. It also uses two-factor authentication (2FA) for account security. For optional security, it provides security locks like PIN codes or biometric authentication. On top of that, it provides notifications for every transaction therefore adding an extra layer of monitoring. However, like any other online financial platform, it is not completely immune to fraud or scams so users need to stay vigilant.

I would recommend users enable all of the above-mentioned security measures and use strong and unique passwords to keep their accounts safe. You also have to beware of phishing attempts. Phishing is a fraudulent practice of sending emails or other messages pretending to be from legitimate companies to con individuals to share their personal information, such as passwords or credit card numbers. Therefore, I would advise users to avoid sharing personal information with unknown individuals. Similarly, It is vital to verify the identity of the person they are transacting with.

As for potential scams, such as fake customer support numbers and phishing emails, always verify and reach out to Cash App’s official support through the app or website to avoid getting scammed.

Can teens use Cash App?

Cash App is mainly designed for adults, with a minimum age requirement of 18 years. However, it also allows teenagers aged 13 to 17 under parental supervision through a dedicated side program called Cash App for Teens. This program allows teenagers to access most of the app’s features which include sending and receiving money but there are certain limitations to ensure safety.

Key Points for Teens:

- Teenagers must have parental approval to access the Cash App.

- Parents or guardians are required to set up and oversee their teen’s account.

- Features like investing in stock or cryptocurrency are restricted for teenage users.

What are Cash App features for teens?

Cash App provides several features for their younger users appropriate to their age group:

- Send and Receive Money: Teenagers can easily send and receive money instantly from their friends and family.

- Cash Card: A customizable Cash Card tailored for younger users is available that can be used for in-store purchases or ATM withdrawals with spending monitored by their parents or guardians.

- Spending Limits: Parents or guardians can set spending limits on their teen’s Cash Card.

- Parental Oversight: Parents have direct control over account settings and can easily monitor their child’s transactions.

Pros and cons of Cash App for teens.

Pros:

- Financial Independence: Cash App helps teens learn financial management, and their importance and equips them with a sense of responsibility.

- Parental Supervision: Parental supervision allows parents to oversee and guide their teen’s financial activities and intervene when necessary.

- Spending Limits: By setting clear limits for your teen’s spending, you are provided with a safety net and you do not have to worry about overspending.

- Ease of Use: Your teenagers can easily manage their finances and learn a lot through this user-friendly Cash App.

Cons:

- Limited Features: The program for teenagers restricts them from features like investing in stocks and cryptocurrency. It therefore prevents them from learning about those things.

- Dependence on Parents: The teenage version of this app requires constant oversight and approval from parents to set up an account or make any financial transactions.

- Potential for Misure: Despite all safety measures in place, there is a risk of your teenagers mismanaging their funds or being exposed to frauds and scams.

Is Cash App safe for kids?

As stated earlier, Cash App is not designed for children under the age of 13. The platform lacks dedicated features to guard younger children from potential risks associated with online financial transactions. Therefore, I would not recommend that kids below the age of thirteen use Cash App. I would also advise parents to consider alternative options, like child-specific financial (and educational) apps that offer better safety and educational features for young children.

Does Cash App have parental controls?

Cash App offers a very basic level of parental controls for teenage users. Still, these features are more than enough if your child is not exceptionally mischievous. Here is what you’ll get with the Cash App’s parental controls.

- Set up Accounts: Parents can initiate and approve the setup of their teenager’s Cash App account.

- Monitor Transactions: You can review and monitor all transactions made by your kid.

- Set Spending Limits: Establish spending limits on the Cash Card and the app itself to control expenditures.

The aforementioned features not only provide a framework for parental oversight but also prove to be quite simple and easy to use.

Do my parents get notified when I use the Cash app?

Parents do not receive notifications for every transaction made by their teen on the Cash App. However, they can access and review transaction history through the through-app monitor. Similarly, notifications can be enabled for significant activities like sending or receiving a large sum of money or when there is a decline in transactions. So, for the most part, your parents will not know immediately if you spend a bit of money on Starbucks or decide to help a friend.

What can parents see on the Cash App?

Parents can view the following on their kid’s Cash App:

- Transaction History: Parents can see the details of all transactions including amounts and recipients.

- Cash Card Activity: Parents can also check records of purchases made and ATM withdrawals made with the Cash Card.

- Account Settings: Parents can overview the account settings, including linked cards and other security features.

This visibility enables parents to keep track of their teen’s financial activities and intervene when necessary.

How to monitor your kid’s transactions on Cash App?

You will just have to set up parental controls on the Cash App to monitor your kid’s transactions. From there, you can review their daily transactions and manage the spending limits on their account. If your child starts to go over budget, you can easily bring them back in line by putting a limit on their card. However, as far as instantaneous reminders are concerned, Cash App lacks a bit in that department.

You’ll instead have to rely on parental control tools like FlashGet Kids to see all of your child’s transactions in real-time. This app provides a comprehensive way to monitor your child’s activities within the Cash App. The notification tracker within this app will help you with quick alerts. You’ll get an update every time your child makes a transaction. Moreover, you can also limit your child’s access to the Cash App using FlashGet Kids altogether.

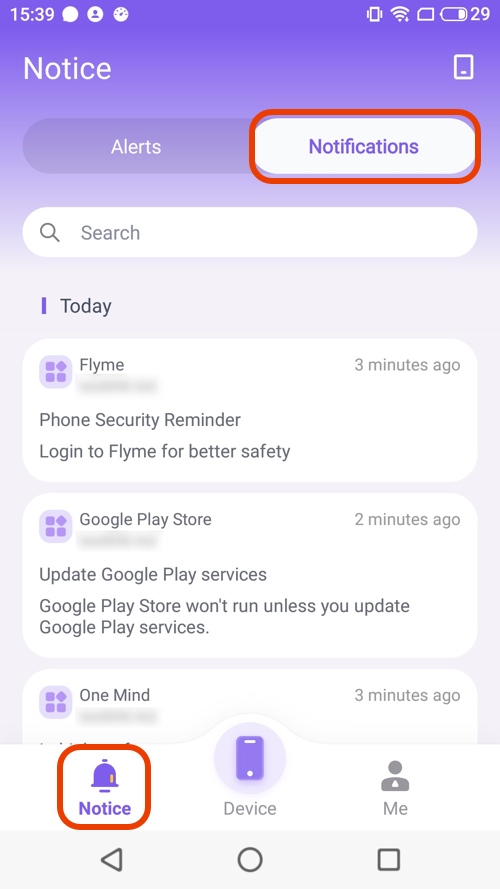

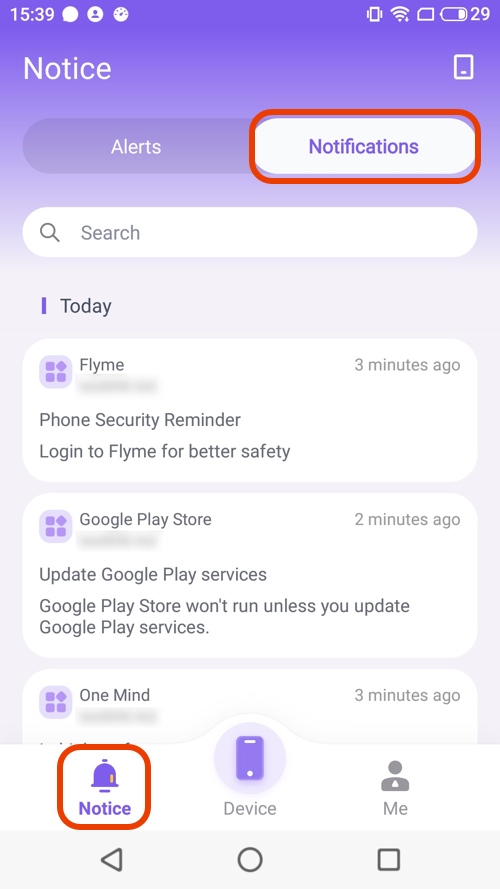

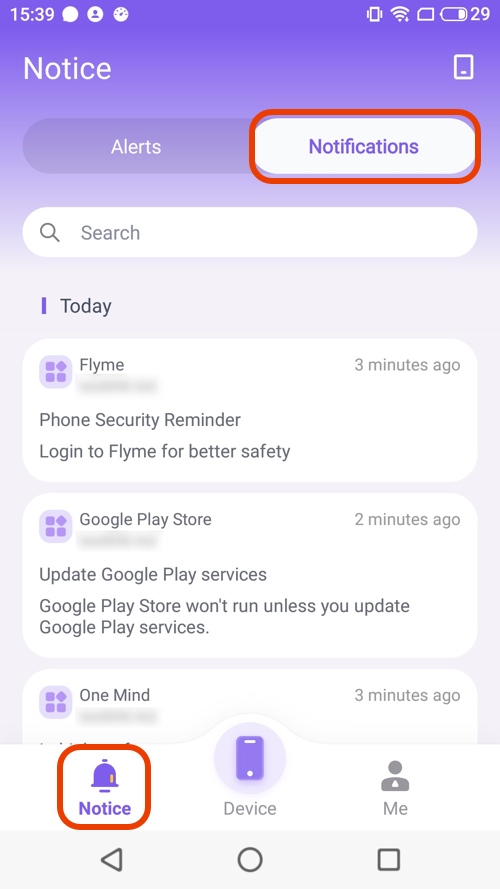

So how to use FlashGet Kids

- Download FlashGet Kids for parent and child app.

- Register a

- Bind child device to parent’s device using FlashGet Kids.

- Give necessary permissions.

- Set up FlashGet Kids on dashboard.

- Tap Notice and find notifications to start monitoring your kid’s transactions.

How to set limits for your kids on Cash App?

Here are the steps to set limits for your kids on the Cash App.

1. Launch the Cash App.

2. Tap on the profile icon.

3. Navigate to the cash card option.

4. Approve the maximum allowed spending amount for the week or the month.

5. Save the updated limit.

These steps are only valid if you have previously set up a family account in the Cash App with your sponsor.

Bonus: Is Cash App better than PayPal? Which is more kid-friendly?

If you are looking for easy ways to make and receive online payments, then you should either stick with the Cash App or PayPal. While many PayPal and Cash App features are similar, there are certain differences in setting up accounts and the fees you will pay for each transaction made. So, go through the following details to pick the best option for your financial needs.

Account Availability:

Cash App is available to US and UK residents only whereas PayPal is available in most countries around the world so PayPal is the clear winner here.

Key Features and Uses:

Cash App offers the following features:

- Spend & receive payments

- Spend with a linked debit card

- Receive direct deposits

- Authorized user accounts available for 13-17 year-olds

Paypal offers the following features:

- Shop online and in person

- Send and receive payments

- Spend with a linked debit card

- Buy now, pay for service later

- Get credit

- Receive direct deposits

- Deposit checks and cash

Fees:

- Cash App: Limited fees, many services are free.

- PayPal: Free to shop online in USD, some free domestic personal payments, fees apply for most other services.

International Services:

Cash App provides international payments between the US and UK only whereas PayPal offers international payments to most countries in the world.

Card Availability:

Cash App provides debit cards only whereas PayPal offers both credit and debit cards to eligible account holders.

Pros & Cons of Cash App and PayPal

Pros:

- Cash App: With Cash App, you can send messages and emojis when you pay. You can send money with the cashtags and there is no need for an email or phone number for your recipient. Cash App also provides stock investment options. It is also one of the most popular finance apps on the app store.

- PayPal: PayPal is a huge and well-known brand with millions of users all over the world. It has a broad global reach and is generally accepted by merchants everywhere. It also has higher account limits as compared to Cash App. You can also deposit checks and cash into your account. It also provides credit to its users.

Cons:

Cash App:

- Only available to US or UK residents

- Limited international services

- No option to pay with cash or check

PayPal:

- Higher fees especially for credit card & international transactions

- Currency conversion costs may be high

Which Payment App is better:

Whether PayPal or Cash App suits you more depends on what is important to you. If you are looking for an account that makes it easier to send money to US-based friends and family and do not mind a limited range of international options, Cash App is there for you. However, if you are more interested in shopping online, PayPal is the better alternative as it is widely accepted all over the world.

Suitability for younger children

Paypal is generally more secure for your financial transactions due to its buyer protection and extensive customer support. On the other hand, Cash App offers a straightforward interface that might appeal to teens. For younger kids, however, neither platform is ideal. For their needs, you have to look for other alternatives appropriate to their age. Moreover, you need to focus on using parental control tools like FlashGet Kids to further regulate their financial activities.

FAQs

Will Cash App refund money if scammed?

Cash App offers refunds for transactions flagged as fraudulent but this is not always guaranteed. Users should report scams immediately to Cash App support.

How long does it take for Cash App to refund a canceled payment?

Refunds can take up to 10 business days and it depends on the bank’s processing times.

What happens if money is sent to a closed Cash App account?

If money is sent to a closed Cash App account, it typically returns to the sender’s account. If that does not happen, you can contact support for assistance.

Does Cash App have privacy?

Cash App provides privacy settings that allow its users to control who can see their activities and transactions. Users can also choose to keep their transaction history private.

Can my parents withdraw money from my account?

No, parents can not do so directly. However, they can monitor and control spending through the app’s parental controls.

Does Cash App get monitored?

Cash App is monitored by the app’s security systems to detect suspicious activities and potential frauds and scams. Similarly, if you have a teen account, your sponsor can see your transactions.