In today’s digital age, teaching children the value of money and responsible financial habits is more important and difficult than ever. But, no worries, The Greenlight app is an innovative solution for all those needs. In this article, you will receive a detailed introduction about this app, including its features and pros and cons. Moreover, you will also learn more about alternative apps like this. So keep reading!

What is the Greenlight app?

Greenlight is an app founded by Tim Sheehan and Johnson Cook in 2014 in Atlanta, Georgia, when they noticed that parents didn’t have a way to teach their kids about money. Greenlight was formerly known as “Greenlight Me”. It is defined as;

“Greenlight is a financial education app that helps kids to learn how to invest and earn. It also teaches how to spend and save credit, which is managed by their parents.”

It’s an objective way for teenagers to experience learning and earning money. It is compatible with iPhones, Android mobile devices, and the Amazon Kindle!

Features

The Greenlight app has many outstanding features that help kids learn and manage credits. These are explained below:

- Debit cards: Greenlight offers a debit card for kids to make purchases, but parents can limit their spending to prevent unnecessary buying.

- Online transfer: This app also allows the online transfer of money between friends & your kid app, which teaches them a lot about the digital banking system.

- Chores pay: With this system, you can assign daily/weekly chores to your kids and when they complete it, you can pay them some allowances, which helps them get responsible from a very small age.

- Earn profit: This app also rewards kids with up to 5% profit on their savings and helps kids learn about business.

- Financial literacy: Greenlight Level Up is a financial literacy game that makes spending money easy for kids by teaching them intelligent ways.

- Crash detection & fraud protection: If any fraud or crash occurs with the kid’s account, it is readily detected and protected by their parents with the help of the Greenlight app.

- Driving reports: This app provides parents with driving reports of their kids, such as their driving speed, fuel use, etc.

- Location sharing: The Greenlight app allows family members to share their live location to stay safe on their journeys.

- Parental controls: The Greenlight app allows parents to control their kids’ steps, such as money spending, driving alerts, location, etc.

- SOS Alerts: The Greenlight app sends immediate alerts to parents regarding their kids’ chores, through which they can protect them from emergencies, such as accidents, getting lost, etc.

Pros & cons

Pros

- Easy to navigate.

- No ATM fees are charged.

- Cashback and savings are rewarded.

- Track the transaction history of kids.

- Set spending control based on categories.

Cons

- No physical cash deposits, only digital deposits.

- It’s quite an expensive monthly subscription.

- Doesn’t work with common money transfer apps like Paypal, Apple Pay, etc.

- The investing option is available only on the expensive monthly tier packages.

What can you not buy with a Greenlight card

You can use your Greenlight card everywhere but with your parent’s permission. However, some items are backlisted due to customer security and privacy concerns, among whom a few are listed below:

- Lotteries

- Massage parlors

- Dating/escort services

- Wires or money orders

- Security brokers or deals

- Non-sport internet gaming

- Horse racing and dog racing

- Cashback at the point of sale

- Online casinos or online gambling

Is the Greenlight app safe? (for families)

The Greenlight app is safe for families due to its undeniable security features, parental control, and transparency. It offers a secure and reliable environment for money management and teaches kids about financial literacy.

The Greenlight accounts are insured by FDIC ( Federal Deposit Insurance Corporation ), so there is no threat of fraud or crash in those accounts, and if they happen, they are detected immediately. Plus, this app does not leak financial or family data, so users’ privacy remains maintained.

Moreover, two-step authentication has added an extra layer of security for families. You log in to your account by providing a username and password, and then the verification code is received via SMS or email. This feature helps protect your account from unauthorized access, making the Greenlight app safe for the family’s use.

Beyond this, the Master card’s zero liability protection also prevents unauthorized transactions through the Greenlight account.

Is the Greenlight app trusted? (for families)

Due to its features, the Greenlight app is trusted by families in many aspects, including financial literacy, debit cards, money management, and family safety. These features help parents easily monitor where and how their kids are spending and earning money.

Most people are currently using it for their kids’ financial safety, and you can see it in the fact that Greenlight has earned 4.8 stars on the Google Play store and more than 370,000 iOS App Store reviews. All these aspects show the families’ trustworthiness of the Greenlight app in this cruel world.

The alternatives to the Greenlight app

There are many alternatives to the Greenlight app and even competitor apps. Some of them are as follows:

i) Chime

ii) Sproutly

iii) GoHenry

iv) GravyStack

v) NatWest Rooster Money

Chime

“Chime is a financial technology-related company that presents all the useful features of mobile banking by making partnerships with national banks.”

The Chime app aims to provide easy-to-use financial products and keep your money safe. Chris Britt co-founded the app in 2013, released it in March 2014, and updated it in May 2024. Moreover, the Chime app is compatible with Android, iOS, Windows, and macOS devices.

Features

The Chime app has following up to the mark features which everyone should know to understand its worth:

- Alerts: The Chime app immediately sends you alerts regarding every activity in your account, either transactions or account balances daily.

- Online billing: Pay your bills directly through the Chime app without going to the bank.

- Check deposit: The Chime app allows you to receive your cash deposits up to two days early.

- Wallet integration: You can integrate your wallet account with mobile wallets, i.e., Apple Pay, Google Wallet, and Samsung Pay.

- Fee-free transactions: There are no monthly fees for transactions. You can send and receive money through the Chime app without paying any fee.

- Disable international transactions: The Chime app allows you to easily disable transactions from foreign countries for your account’s safety.

Pros & cons

Pros

- No monthly fees.

- Early direct deposit.

- Easy to use and access.

- Allows overdraft up to a specific limit without paying any fee.

Cons

- No branch access.

- No parental controls.

- Pay fees for the cash deposits.

- Lack of knowledge regarding unauthorized account opening and its use.

Sproutly

“Sproutly is a comprehensive learning tool which provides banking services through the Providus bank.”

The Sproutly app aims to help individuals and families manage their finances. Christopher George and his team founded it, and it is compatible with iOS, iPad, and macOS.

Features

- Budgeting tools: Sproutly provides different tools to record banking transactions and sends immediate alerts regarding account activity.

- Real-time tracking: With the help of the Sproutly app, parents can track their child’s or other family member’s location in one click.

- Multi-account support: Through the Sproutly app, you can manage multiple accounts under one login.

- Educational insurance & student loans: Sproutly provides you with educational insurance for your kids and also helps students learn and get their education easily with student loans.

Pros & cons

Pros

- NDIC insured.

- No hidden and overdraft fees.

- Allows overdraft for emergencies.

- Withdraw cash at over 50,000 ATMs.

Cons

- Insecure privacy.

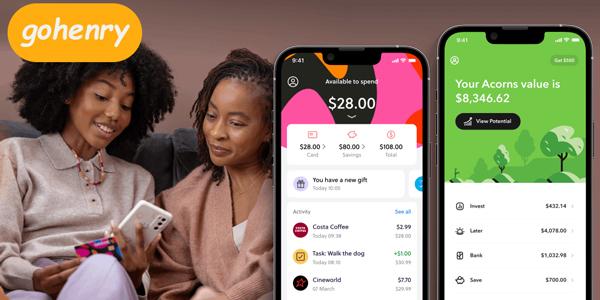

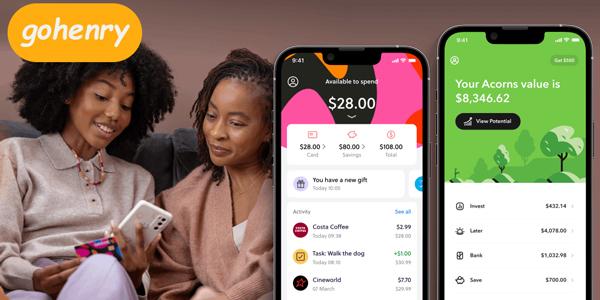

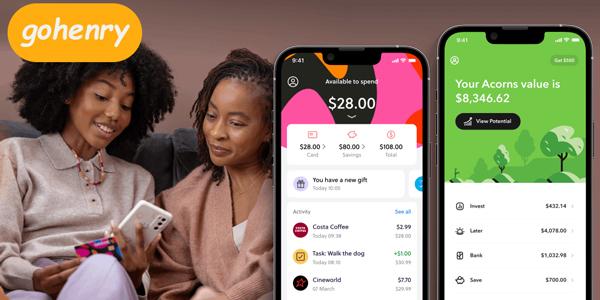

GoHenry

“GoHenry is the UK’s #1 finance management app for kids and teens aged 6-18, teaching them how to save, spend, and earn money.”

Founded by Louise Hill and Dean Brauer in 2012, GoHenry is an excellent app is compatible with iPhones, macOS, and Androids. This app has been designed to help parents watch and guide their children in financial safety.

Features

- Task list: Parents can create a list of tasks for their kids to earn extra money using the GoHenry app.

- Parental controls: Parents can control all the activities of their children’s accounts, such as sending and receiving money, setting limits for each activity, etc.

- Account management: You can manage your account by viewing transaction history, account balances, and statements.

- Real-time notifications: The GoHenry app provides notifications and alerts of all the transactions and account details.

- Multi-accounts management: Parents can manage more than one child’s account through this app.

Pros & Cons

Pros

- Rewards system.

- Customized cards.

- One-time free trial.

- Free ATM withdrawals.

Cons

- No interest paid.

- High monthly fees.

- Additional fee for cards.

- Overseas charges are applied.

GravyStack

“GravyStack is a finance management app designed for kids to learn how to earn, save, and share money.”

Founded by two parents, Scott Donnell and Travis Adams, in 2022. GoHenry is an excellent and exciting app that combines banking with gamification to increase kids’ interest in earning and saving money. The app aims to make kids understand the importance of money and hard work in achieving financial goals.

Features

The GravyStack app has the following undeniable features that everyone should know to understand its image:

- Home Gigs: This app allows parents to arrange a schedule of home chores for their kids and earn extra money as a reward.

- Three-jar system: This app allows you to divide your money into three jars, such as Spend, Save, and Share, to teach kids about allocation and prioritization.

- Real-time monitoring: GravySTack allows you to monitor your kids’ activities and easily monitor their every move.

- Customisable controls: This app allows parents to set limits, lock the card, and control where the card can be used.

- Multi-account handling: This app allows parents to manage more than one account at a time.

Pros & Cons

Pros

- Free to use.

- Holistic approach.

- Family-friendly app.

- Encourages responsibility.

Cons

- X Zero reminders.

- X Minimal parental involvement.

NatWest Rooster Money

“NatWest Rooster Money is a family pocket money management app that helps parents to teach their kids about money and saving goals.”

This app is available for kids aged 6-17 years and helps them learn and earn money to make their pocket money. It is compatible with all devices, including smartphones, iPhones, iPads, etc., and has many useful features.

Features

The following are many great features of this app:

- Parental controls: This app helps parents easily monitor and track their kids’ spending and receiving money in their accounts.

- Schedule allowance: Parents can schedule the allowance for their kids through NatWest Rooster Money.

- Freeze/unfreeze card: Depending on the conditions, parents can freeze or unfreeze their children’s debit cards to prevent unusual spending.

Pros & cons

Pros

- Free card use.

- One-month free trial.

- Provides Transaction history.

- Instant notifications and alerts of every activity.

Cons

- No interest.

- Annual fees are to be paid to get full access to features.

- Card is free and limited to 3 loads a day or 10 a month.

How do you monitor your kid’s digital footprints?

Undoubtedly, all the above-mentioned apps are excellent sources of money management for kids and their parents. However, to check whether kids have used them wisely or not, it’s necessary to monitor their mobile activities, and for that, you can use a highly professional parental control app like FlashGet Kids.

“FlashGet Kids is the best parental control app to monitor and manage kids’ mobile.”

FlashGet kids have an amazing feature that can help you monitor their spending such as with Screen mirroring, sync notification, and keyword detector feature, you can keep track of their activities, and if you find anything suspicious, you can instantly block the apps from anywhere in the world. So, it is recommend to use this app to help your kids grow in a safe environment.

FAQs

How much is Greenlight monthly?

Greenlight costs 4.99$ to 14.98$ per month depending on the package the user buys for monthly use.

How much money can you spend a day on Greenlight?

Greenlight allows you to spend up to 1500$ daily point of sale per family or for sub-accounts as well. However, you can set your own limits according to each account.

Do you need a bank account for Greenlight?

Yes, you need a bank account for Greenlight. But you don’t have to get a new account. You can use your older account to load your Greenlight card as well.